Grant Management

Grant management is a system that includes applying for and securing grants, adhering to requirements, disbursing funds, evaluating outcomes.

Grants are provided to fulfil a specified purpose, a definite outcome. Provided to institutions constituted or incorporated as such by law.

Recipient, Sub-recipient and Vendor

Recipient is the organisation receiving the grant. A recipient is sometimes called the Prime because they have the full responsibility for the funds. The document evidencing is a grant contract

Sub-recipient is involved in substantive activities of the award project. The recipient passes on some or all of its duties to the sub-recipient through a sub award. All the terms and conditions from the grant award flow down to sub-recipients through the sub-award. The document evidencing is a sub grant contract

Vendor/service provider, is one who provides goods/services to the recipient so the recipient can accomplish the project’s purposes. Selected terms and conditions might be passed through to the vendor. The document evidencing is a contract

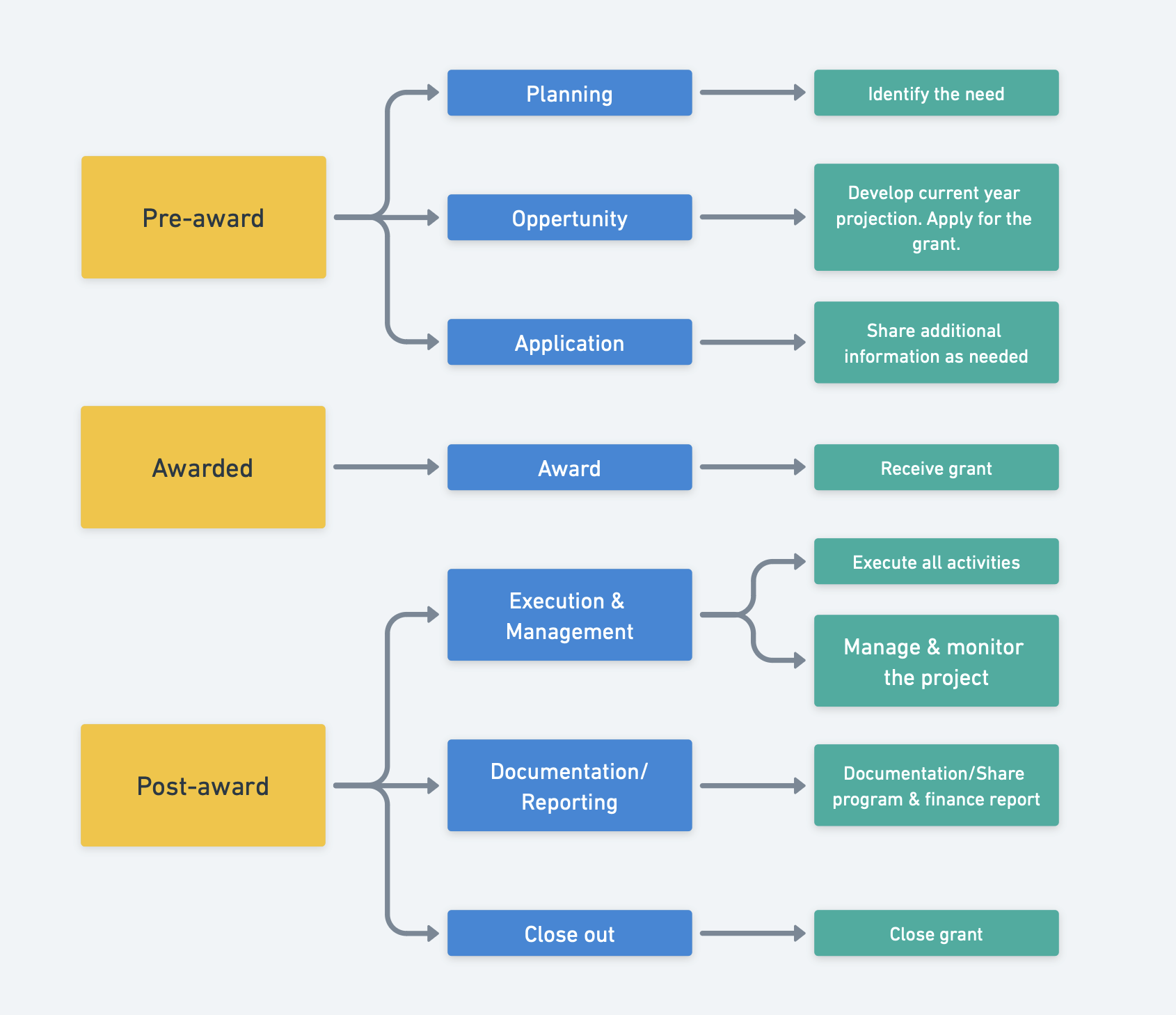

Grant management lifecycle

Illustrated:

Pre award:

- Planning

- Identify the need

- Opportunity

- Develop current year projection. Apply for the grant.

- Application

- Share additional information as needed

Awarded:

- Award

- Recieve grant

Post award:

- Execution & Management

- Execute all activities

- Manage & monitor the project

- Documentation/Reporting

- Documentation/Share program & finance report

- Close out

- Close grant

Principles of grant management

-

Accountability & Transparency with respect to utilisation of grant funds.

-

Efficient & Effective use of the grant funds.

-

Compliance with applicable laws of the land.

-

Adherence with terms and conditions of Grant Agreement.

-

Internal controls i.e. financial and accounting systems, budgetary control, funds management.

-

Timely submission of narrative and financial reports as required under the grant.

Prerequisites for robust grant management system

-

Policies & Procedures (Finance & HR)-ensuring strong internal control environment

-

Accounting-ICAI Technical Guide for accounting of NPOs-framework

-

Fund based accounting for presentation of financial statements

-

Accrual basis of accounting

-

Maintenance of prescribed books of accounts

-

Accounting Standards as framework for recording and reporting in financial statements

-

- Segregation of duties-checks and balances, dedicated finance staff

- Encourage audit and assurance-risk mitigation

General Conditions of a Grant:

-

Definition of Terms used in the grant Agreement.

-

Commitments from Funder side.

-

Commitments from the grantee side.

-

Rights arising out of contracts.

-

Technical and Scientific Reports.

-

Fixed Assets and Equipments: where should they be used and how they will vest at the project end.

-

Project Termination, normal, premature or in abnormal circumstances. Force majeure.

- Dispute Resolution.

- Confidentiality.

- Interest and Project Income.

- Employment.

- Force Majeure.

- Intellectual Property.

- Delegation.

- Notices.

Operational Terms and Condition of Grant

Example:

-

Basis of accounting

-

Separate Books of Account and separate Bank Account for Grant Funds

-

Bills and Vouchers defaced with mention of project

-

Limit on Cash Expenditure.

-

Treatment of interest

-

Procurement rules

-

Inclusion of clauses as per the laws of land

-

Program/Financial reporting and audit timelines

-

Treatment of Fixed Assets

-

Income generated from project activity

-

Closure of grant

After grant signing, a “Compliance Calendar” be prepared to ensure all terms and conditions are being adhered as per grant.

Robust Grant Monitoring System

Grant monitoring is a process to measure/review performance during grant period. It assesses physical & financial progress, identifies risks and corresponding mitigation measures, ensures that funds are used as intended and programs achieve desired outcomes and impact.

Important Tools and Process:

-

Complete understanding of terms and conditions of Grant contract.

-

Budget and LFA clearly known to both finance and programme teams.

-

Periodic Budget Variance/Deviation Analysis by finance and programme team and review by top management.

-

Timely course correction through realignment etc through addendum in grant contract.

-

Timely reporting-narrative and financial reports as stipulated in the grant contract.

Interest apportionment:

-

With a single bank account for multiple projects, interest apportionment for reporting to donors has to be made as per well defined method.

-

Interest apportionment not applicable for a dedicated bank account.

-

Interest can be additive or deductive from grant as specified in grant agreement.

Common/Core Cost

Salary Allocation for multiple projects:

Please note: Information is for reference only. Read our disclaimer here.

No Comments