Fund Accounting, Costs, Budget & Grant Management

You can read the information below in over 15 languages! Simply use the translation tool in the top-left corner of the screen to select your preferred language, including অসমীয়া, বাংলা, ગુજરાતી, हिन्दी, ಕನ್ನಡ, മലയാളം, मराठी, মৈতৈলোন্, नेपाली, ଓଡ଼ିଆ, ਪੰਜਾਬੀ, संस्कृतम्, தமிழ், తెలుగు, and اُردُو.

Got questions about Fund Accounting? Ask them on the forum.

Fund Accounting, Income Types & Aspects Of A Grant

Fund Accounting

NGOs follow Fund based Accounting for managing grants

-

Fund accounting is an accounting system for recording resources (fund) where its use has been limited by the donor.

-

This accounting system emphasises accountability/productively over profitability which is the accounting basis for for profits

-

A separate budget is established for each fund.

-

Fund accounting utilises good internal control and reporting systems

Income of IPs-Types of Funds

Income of charitable institutions being headless is reported under following categories:

-

Aggregate Income from property held in trust (Schedule AI)

-

Voluntary contribution (Schedule VC)

-

Capital Gains

Types of funds (specified by ICAI):

Unrestricted funds: Funds received with no specific restrictions categorised as:

- Corpus-non-refundable, non reducible, reinvestment obligation

- Designated/earmarked funds-appropriated and set aside for specific purpose/future, self imposed but not legally binding

- General funds-neither designated nor restricted and also surplus/deficit transferred from I&E

Corpus comply with Income Tax provisions - Section 11(5) modes of investment, Section 11(1)(d) not treated income.

Corpus donation to another registered entity not considered application.

Corpus application to be considered application in the year of replenishment.

Corpus should be shown as Capital and income earned shown in I&E.

Restricted funds:

- Project/program grants-Project Grants to be utilised as per terms and conditions of award, restriction on both utilisation and income earned from such funds. Principle of fund based accounting

- Endowment funds: fund amount cannot be utilised, only income utilised for general/specific purpose as per terms.

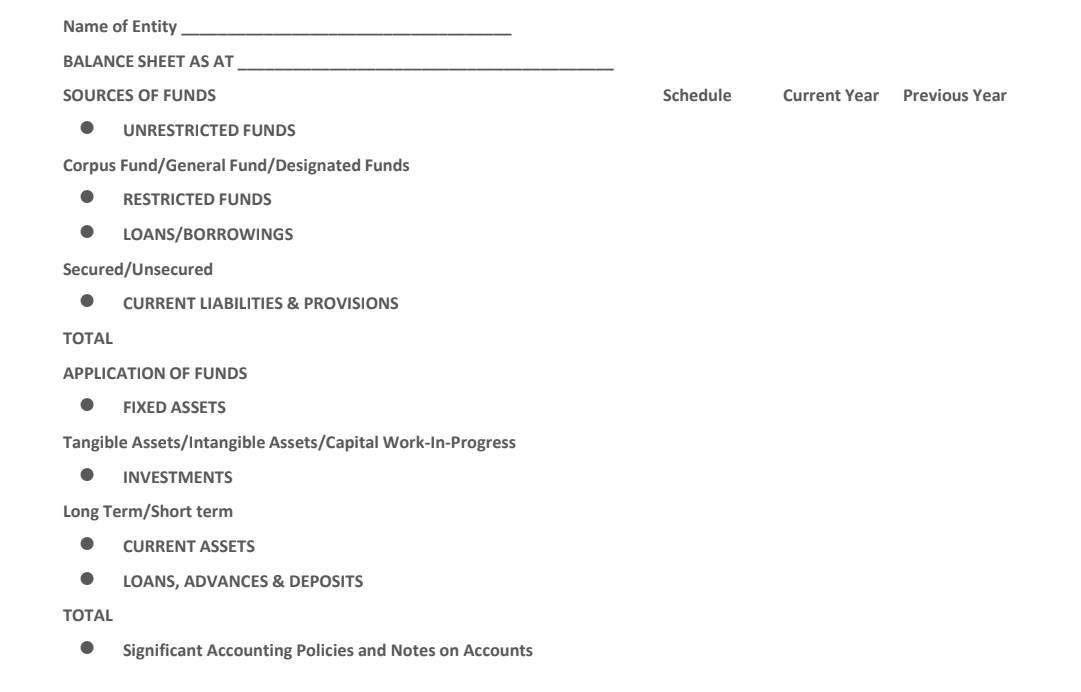

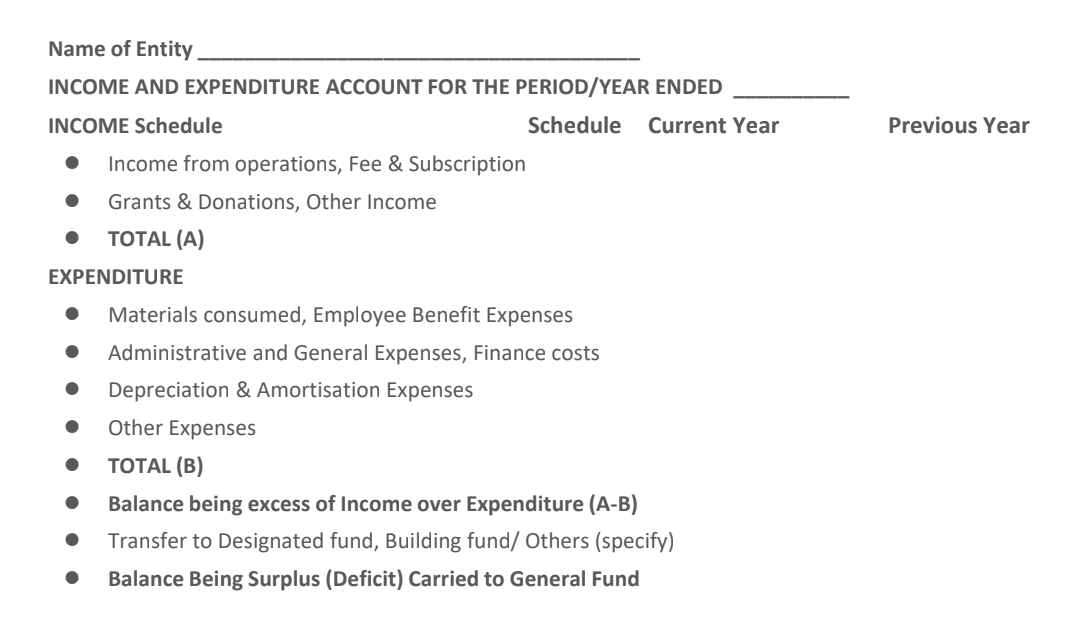

- Format of financial statements as per ICAI

Accounting treatment for grants to NGOs

Grant is trust money. 3 options followed as per convention:

Option 1: Grant treated only as income.

Option 2: Grant treated only as liability.

Option 3: Grant treated as income to the extent of expenditure-hybrid method.

AS 9 mentions income recognition to the extent of expenditure for grants applicable if there is business/commerce etc.

Follow the principle of prudence in selecting the right option.

Grant Management

Grant management is a system that includes applying for and securing grants, adhering to requirements, disbursing funds, evaluating outcomes.

Grants are provided to fulfil a specified purpose, a definite outcome. Provided to institutions constituted or incorporated as such by law.

Recipient, Sub-recipient and Vendor

Recipient is the organisation receiving the grant. A recipient is sometimes called the Prime because they have the full responsibility for the funds. The document evidencing is a grant contract

Sub-recipient is involved in substantive activities of the award project. The recipient passes on some or all of its duties to the sub-recipient through a sub award. All the terms and conditions from the grant award flow down to sub-recipients through the sub-award. The document evidencing is a sub grant contract

Vendor/service provider, is one who provides goods/services to the recipient so the recipient can accomplish the project’s purposes. Selected terms and conditions might be passed through to the vendor. The document evidencing is a contract

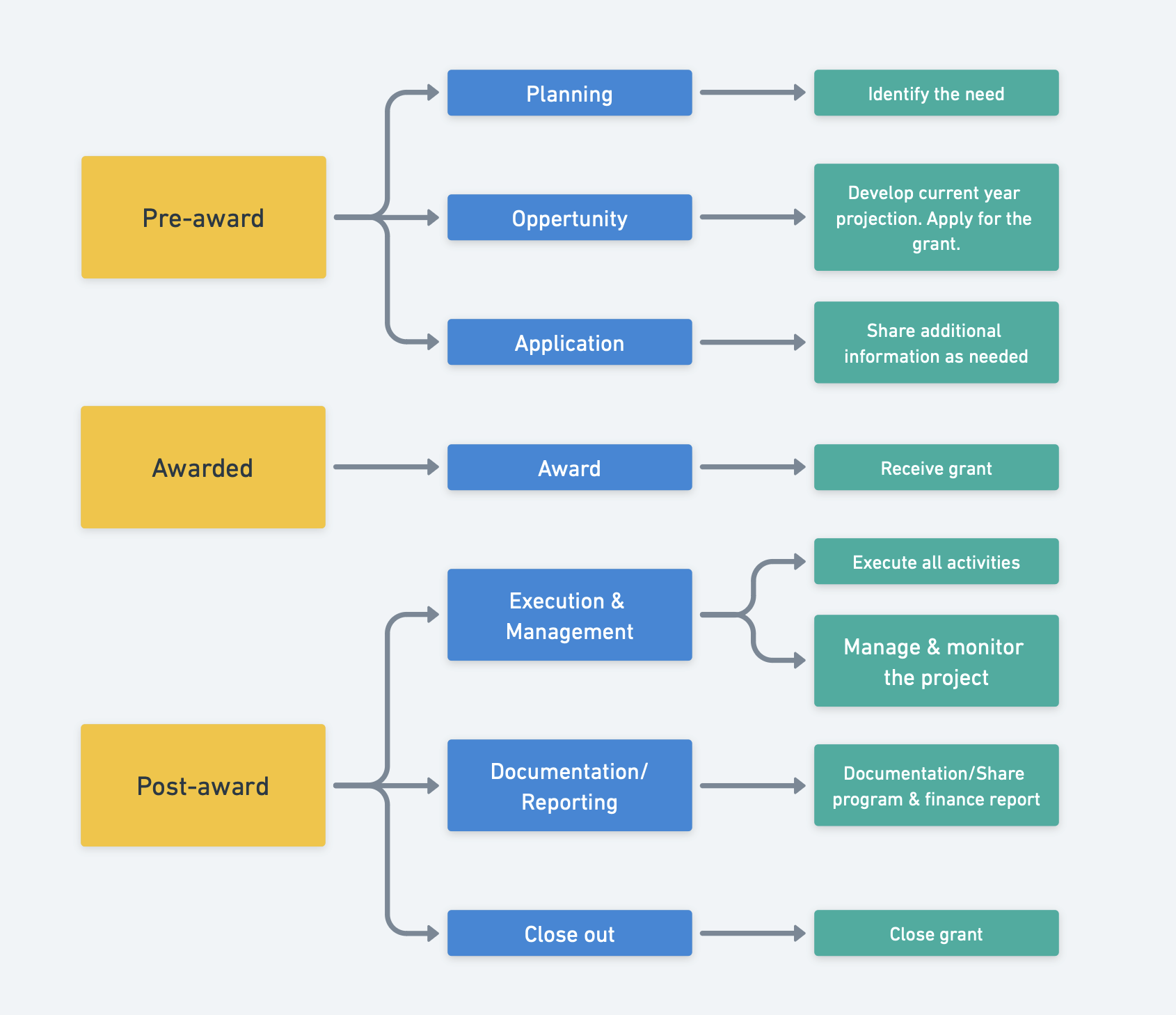

Grant management lifecycle

Illustrated:

Pre award:

- Planning

- Identify the need

- Opportunity

- Develop current year projection. Apply for the grant.

- Application

- Share additional information as needed

Awarded:

- Award

- Recieve grant

Post award:

- Execution & Management

- Execute all activities

- Manage & monitor the project

- Documentation/Reporting

- Documentation/Share program & finance report

- Close out

- Close grant

Principles of grant management

-

Accountability & Transparency with respect to utilisation of grant funds.

-

Efficient & Effective use of the grant funds.

-

Compliance with applicable laws of the land.

-

Adherence with terms and conditions of Grant Agreement.

-

Internal controls i.e. financial and accounting systems, budgetary control, funds management.

-

Timely submission of narrative and financial reports as required under the grant.

Prerequisites for robust grant management system

-

Policies & Procedures (Finance & HR)-ensuring strong internal control environment

-

Accounting-ICAI Technical Guide for accounting of NPOs-framework

-

Fund based accounting for presentation of financial statements

-

Accrual basis of accounting

-

Maintenance of prescribed books of accounts

-

Accounting Standards as framework for recording and reporting in financial statements

-

- Segregation of duties-checks and balances, dedicated finance staff

- Encourage audit and assurance-risk mitigation

General Conditions of a Grant:

-

Definition of Terms used in the grant Agreement.

-

Commitments from Funder side.

-

Commitments from the grantee side.

-

Rights arising out of contracts.

-

Technical and Scientific Reports.

-

Fixed Assets and Equipments: where should they be used and how they will vest at the project end.

-

Project Termination, normal, premature or in abnormal circumstances. Force majeure.

- Dispute Resolution.

- Confidentiality.

- Interest and Project Income.

- Employment.

- Force Majeure.

- Intellectual Property.

- Delegation.

- Notices.

Operational Terms and Condition of Grant

Example:

-

Basis of accounting

-

Separate Books of Account and separate Bank Account for Grant Funds

-

Bills and Vouchers defaced with mention of project

-

Limit on Cash Expenditure.

-

Treatment of interest

-

Procurement rules

-

Inclusion of clauses as per the laws of land

-

Program/Financial reporting and audit timelines

-

Treatment of Fixed Assets

-

Income generated from project activity

-

Closure of grant

After grant signing, a “Compliance Calendar” be prepared to ensure all terms and conditions are being adhered as per grant.

Robust Grant Monitoring System

Grant monitoring is a process to measure/review performance during grant period. It assesses physical & financial progress, identifies risks and corresponding mitigation measures, ensures that funds are used as intended and programs achieve desired outcomes and impact.

Important Tools and Process:

-

Complete understanding of terms and conditions of Grant contract.

-

Budget and LFA clearly known to both finance and programme teams.

-

Periodic Budget Variance/Deviation Analysis by finance and programme team and review by top management.

-

Timely course correction through realignment etc through addendum in grant contract.

-

Timely reporting-narrative and financial reports as stipulated in the grant contract.

Interest apportionment:

-

With a single bank account for multiple projects, interest apportionment for reporting to donors has to be made as per well defined method.

-

Interest apportionment not applicable for a dedicated bank account.

-

Interest can be additive or deductive from grant as specified in grant agreement.

Common/Core Cost

Salary Allocation for multiple projects:

Costs & Budgets

Types of Cost

Capital & Revenue cost:

- Capital costs: are one-time purchases of fixed assets that will be used for revenue generation over a longer period - more than one year.

- Revenue costs: are referred to as operating expenses, which are short-term expenses that are used in running the daily business operations.

Fixed and Variable Costs:

- Fixed cost is one that does not change in total within a reasonable range of activity. Since the fixed cost remains constant in total, the fixed cost per unit of activity decreases when the volume increases, and increases when the volume decreases.

- Variable cost or expense is where the total cost changes in proportion to changes in volume or activity.

Nonprofits account for functional expenses-allocation based on purpose of the expense:

-

Direct Costs: A cost which results in direct benefit to a beneficiary. Can be directly attributed to a program or intervention. No cost if no program activity. Categorised as Program and Admin/Operating costs.

-

Overheads/Indirect/Common costs are core/support costs for general/administration, fundraising etc. These costs are not directly attributable to any specific outputs. Suitable common cost policy for computing Indirect cost rate (ICR) detailing the allocation principle and updation of rate for negotiation with the donors. Common direct cost is also an indirect cost.

-

Historical cost: the price paid for a god when it was purchased.

-

Sunk cost: money spent that cannot be recovered.

-

Marginal cost: increase or decrease in the cost of producing one more unit or serving one more customer.

-

Opportunity cost: forgone cost for available alternatives given the resource constraint.

Cost Principles in grant budgeting

Costs budgeted for a project grant should be:

-

Allowable cost - costs which are not subject to any restrictions/limitations in the grant award.

-

Allocable cost - costs which are incurred specifically for the attainment of the objective of the grant.

-

Reasonable cost - cost which is generally recognized as necessary to be incurred by a prudent person in the conduct of normal business.

-

Consistent cost - this is applied in the same fashion throughout the grant.

-

Unallowable cost - those costs that cannot be incurred and paid under the grant.

What is a budget?

A budget is an estimation of revenue and expenses over a specified future period of time. A budget is a financial plan. It is financial blueprint of the project plan. Pre requisites are:

-

Organisation structure.

-

Data.

-

Chart of accounts.

-

Managerial support.

-

Formal process of budgeting.

Types of Budgets: Activity budget

Activity based budget, as the name suggests, covers the costs required for implementing a project activity.

For example: If project strategy is to build the capacity of civil society leaders, workshops are an activity. Workshops costs would be towards hiring resource persons, booking a venue, transportation cost, food, lodging and materials and handouts.

Illustration: Activity Budget for Conducting a Workshop

|

Particular of Expense |

Rate per unit |

No of Units |

Total in Rs |

|

Trainer Fees |

@ Rs 1000 per day |

3 days |

3,000 |

|

Venue |

@ Rs 500 per day |

3 days |

1,500 |

|

Rental for Furniture |

@ Rs 500 per day |

3 days |

1,500 |

|

Rental for Equipment |

@ Rs 100 per day |

3 days |

300 |

|

Catering Exp for Lunch and tea two times |

@ 100 per person |

55 persons X 3 days= 165 |

16,500 |

|

Conveyance paid to attendees |

@Rs 50 per person per day |

50 attendees x 3 days = 150 |

7,500 |

|

Printing of handouts |

@ Re 1 per page |

50pages x 50 copies= 2500 pages |

2,500 |

|

Grand Total |

32,800 |

Line Item Budget

-

A Line-item budget presents the budget under broad areas.

-

A line-item budget is one in which the individual financial statement items are grouped by category.

-

As you will see in the image below, there are categories (in most cases, given by donors in proposal formats) and you are required to prepare the budget under these categories. Major donors like USAID, European Commission prefer to have their budget templates by line items.

|

Line Item Budget |

||||

|

Expenses |

Units |

# of Units |

Unit Rate ($) |

Costs ($) |

|

Human Resources: |

||||

|

CEO |

Per day |

3 |

350 |

1,050 |

|

Trainer Fees |

Per day |

2 |

200 |

400 |

|

Subtotal Human Resources |

1,450 |

|||

|

Travel: |

||||

|

Trainer Airfare |

Per Person |

1 |

300 |

300 |

|

Participant Transportation |

Per Person |

30 |

10 |

300 |

|

Subtotal Travel |

600 |

|||

|

Equipment & Supplies: |

||||

|

Materials & hand-outs |

Per Person |

30 |

15 |

450 |

|

Total Equipment & Supplies |

450 |

|||

|

Other Costs, Services: |

||||

|

Venue |

Per Day |

2 |

300 |

600 |

|

Catering |

Per Person |

30 |

15 |

450 |

|

Subtotal Other Costs, Services |

1050 |

|||

|

Subtotal |

3550 |

|||

|

Overhead (10%) |

355 |

|||

|

Total |

3905 |

|||

Types of Budget

Incremental budget: New budget by making only some marginal changes to the current budget. The current budget is used as a base to which incremental assumptions are added or subtracted from the base amounts to determine new budget amounts.

Value Proposition Budgeting focuses on allocating the ideal amount of financial resources to make a product or service that provides the highest value to the customer. Another name for Value Proposition Budgeting is Priority Based Budgeting. .

Zero-based budgeting (ZBB) based on efficiency and necessity rather than budget history. Management starts from scratch and develops a budget that only includes operations and expenses essential to running the business; there are no expenses that are automatically added to the budget.

Performance based budget (PBB) is one that reflects both the input of resources and the output of services. The goal is to link funding to results delivered.

Fixed Budget: not modified for variation in actual activity.

Flexible budget: budget changes in response to activity level

Balanced, Surplus and Deficit budgets:

-

A balanced budget is a budgeting process where total expected revenues are equal to total planned spending.

-

A budget deficit occurs when expenditures surpass revenue.

-

A budget surplus means there is additional money to spend at the end of the accounting period.

Budgeting & Budgetary Control

The purpose of budget is to:

-

Ascertain reasonable estimation of costs for interventions/activities in a grant proposal/award. It is budgeting the plan.

-

Segregates direct/common/indirect or OH costs.

-

Depicts cost matching/sharing (co-financing) for multi donor grant.

-

Is a framework for a grant for donor-donee.

-

Enables course correction based on measurement of actual achievements versus estimates.

Budgetary control is the process to:

-

Track income and expenditure (annual and cumulative) by budget lines versus original/revised (realigned) budget based on record of income and expenditure budget line and activity wise entered timely in books.

-

Ascertain deviation/tolerance for expenditure under budget lines in grant award and timely approvals for spends beyond permissible limits.

Please note: Information is for reference only. Read our disclaimer here.

No Comments