Social Security Laws for NGOs

Read the information below in 15+ languages by selecting your preferred language using the translation tool in the top left corner of the screen.

Got questions about Social Security Law? Ask them on the forum or see what Social Security Laws related questions people are asking here.

Why comply with other laws

Section 12AB of Income Tax Act state that: For non-compliance of such requirements of any other laws for the time being in force by the trust or institution as are material for the purpose of achieving its objects. The CIT may cancel the registration certificate basis due process in law.

Social Security Regulations for NPOs-Snapshot

EPF: EPF, EPS and EDLI are 3 schemes under the Employees' Provident Funds and Miscellaneous Provisions Act, 1952 managed by EPFO. Aapplicability: Mmandatory for organizations with 20 or more employee (including employees through contractor unless it has a sperate code, Apprentices unless appointed under Payment of Apprentice Act) for establishment specified in Schedule 1. NGOs are covered under EPF since 1.4.2015 by law. In house PF trusts allowed if the return is equal or higher than what is paid by EPFO

ESI: Employees' State Insurance is a self-financing health insurance scheme for Indian workers. Ambiguity regarding applicability to an establishment but charitable medical and educational institutions run by trust, societies etc covered. The fund is managed by the Employees' State Insurance Corporation under ESI Act 1948.

Applicability: It is mandatory for organizations with 10 or more employee.

Minimum Wages Act 1948: Centre & states fix minimum wage, to be revised at least once every 5 years for scheduled employment. Per hour/day/month rate for 4 defined categories of workers i.e. unskilled, semi-skilled, skilled and highly skilled.

Professional Tax Act: Levied on persons earning income by way of either practicing a profession, employment, calling or trade. PT is levied by state/UT.

Applicability: Out of 28 states, PT applicable in 21 states. Not applicable in states of Delhi, UP, Rajasthan, HP, Uttaranchal, Arunachal Pradesh and Haryana. Rates based on income slabs with deduction not above Rs.2500/- PA. Exemption for certain categories. Multi state operations-PT regn in each of those states. Deduction and deposit frequency may vary as per respective state act.

Maternity Benefit Act 1961: 26 weeks-8 weeks prenatal and 18 weeks postnatal (2017 amendment from 12 weeks) paid leave during maternity period for first two children. Applicable when 10 or more employees and minimum 80 days work by employee in 12 months for eligibility. 12 weeks for more than 2 children and adoption, 2 weeks for tubectomy, 6 weeks for miscarriage and MTP and additional 1 month in case of illness certified by medical practitioner. Creche facility if employee strength above 50.

Gratuity: The Payment of Gratuity Act 1972 is applicable on establishments with 10 or more employees.

Shops & Establishment Act: State Act. Applicability based on coverage of charitable institution within the definition of ‘Establishment/Commercial Establishment’. Regulates working hours, opening closing, holidays, employment of children, leaves including earned leave, OT etc. Need to obtain license and furbish necessary returns.

Apprentices Act 1961: to regulate training in industry/establishment as per a contract for apprenticeship. Establishment with 30 or more workers must engage apprentices in range of 2.5-15% of workforce. Provided stipend during training based on category of apprentice i.e. trade, graduate, technical, vocational based on prescribed benchmarks. Apprentice is not a worker and therefore labor laws not applicable. Reporting requirements for employer.

Sexual harassment of Women at Workplace (Prevention, Prohibition & Redressal) Act 2013: Policy against sexual harassment of women at workplace, it can be gender neutral also, Internal committee (IC) where employee strength exceeds 10, create awareness and visibility of POSH and IC, management facilitate enquiry for POSH matters to IC, Annual reporting by IC to management and district authority if more than 10 employees. POSH compliance in Directors Report for company.

EPF & Misc Provisions Act 1952:

- Inclusion: Employee Provident Fund scheme (EPF) 1952, Employee Pension Scheme (EPS) 1995 and Employee Deposit Linked Insurance Scheme (EDLI), 1976

- Eligibility: All employees (full/part time) working for more than 30 days in a year covered. Once an employee always an employee, once an establishment always an establishment.

- Excluded Employees: employee whose pay is more than Rs. 15,000 a month at the time of joining provided he is not member of EPFO. For coverage of establishment, both coverable and excluded total to be considered. Not available for Newspaper establishment. Employees drawing less than Rs 15,000 per month have to mandatorily be members.

- EPF Scheme: The contribution paid by employer and employee is 12 per cent each of basic wages (including fixed allowances), DA plus retaining allowances. Contribution eligible for 80C benefit and interest is exempt from tax-for FY 24-25 it is 8.25%.

- EPS: Minimum 10 yeas of contributory service or attaining 58 years of age (reduced pension from 50-57 yrs and defer pension beyond 58) and whether in service or superannuated.

- 6 type of pension-superannuation, disabled, widow/child pension, orphan, nominee,

- dependent parents pension/ Pension= Pensionable Salary (average of last 60 months) X

- Pensionable Service)/70. Provide life certificate annually in November of each year

- EDLI: Insurance benefit min 2.5 lakhs upto Rs.7.0 lakhs in case of death while in service to family member/nominee

- 12% employee share to EPF, 12% employer share-8.33% for EPS upto Rs.1250/- per month and remaining plus 3.67% to EPF, EDLI contribution (0.5%) and EPF admin charges (0.5%) paid by employer. Total liability on employer is 13%. Can restrict contribution to Rs.15k i.e. PF wage ceiling for all employees even if comp is more than 15k. Employer share can be restricted to 15k as per law.

- Any organization employing less than 20 employees can opt for voluntary coverage with 10 % Contribution

- Tax on withdrawal of EPF >50k less than 5 years-TDS 10%

- UAN-12 digit for all previous and current memberships

- Final PF withdrawal: Form 19 for EPF made online

- Interest- exempt from tax except for interest on employee contribution exceeding Rs.2.5 lakhs per annum from 1.4.2021

-

EPF Deposit: by employer within 15 days of close of month online and submit ECR which captures both payment and filing. Non deposit by 15th entails interest and penalty. Member will earn interest even if there is default by

employer

-

Various forms for services and all submission online now. E nomination by members mandatory.

-

Deposit in PPF account is not compliance under EPF

-

Non refundable Advance from EPF contribution for various needs permitted

-

HR department should ensure that e KYC of employees (Linking of Aadhar, Mobile Number, Email id, PAN, E- nomination etc.) are complete in the EPFO site.

-

An employee, who has resigned / terminated from the organization should be

exited from the EPF portal within 2 months of last contribution by the employer.

-

In order to avoid mingling of funds for FC and NFC EPF contribution, it is

advisable to generate separate challan for employees paid from FC and NFC

respectively.

-

An individual who joined the Employees' Provident Fund (EPF) scheme after September 1, 2014, cannot open an Employees' Pension Scheme (EPS) account if his/her monthly salary exceeds Rs 15,000. In such cases the complete 12% of share will go to provident fund account.

-

Form-11 to be obtained and kept in employee files for all exempted employees.

-

Register of Wages, Leave, Advances / Loan, Fine to be maintained by the employer.

ESI Act 1948-Compliances

🕟 Eligibility: All the employees (full time/part time) working with the organization for more than 30 days in a year are eligible for ESI Benefits.

💴 Employees earning daily average wage up to Rs.176 are exempted from ESIC contribution. Employer will contribute both shares

💵 As per the rules, in ESI, employee whose ‘gross pay’ is more than Rs 21,000 in a month are not eligible for ESI benefits. Employees drawing less than Rs 21,000 per month have to mandatory become members of the ESI.

💰 Contribution by Employer and Employee: The contribution paid by employer is 3.25 per cent of wages. The employee will contribute 0.75 per cent of wages. Deposit within 15 days of closing of month. Benefits: Medical, Sickness, Maternity Disablement, Dependents, Funeral.

Payment of Gratuity Act 1972

- Eligibility: As per section 4(1) of payment of gratuity Act 1972, gratuity shall be payable to an employee on superannuation, termination, resignation of employment after he has rendered five years (4 years and 240 days) or more. continuous service or on death/disablement due to accident/disease (5 year rule not applicable in such cases)

- Applicable to organization with 10 or more employees in previous 12 months

- Calculation: The gratuity amount depends upon the tenure of service and last drawn salary. Formula: Last drawn salary (basic salary plus dearness allowance) X number of completed years of service X 15/26. Maximum ceiling Rs.20 lakhs

- Due for payment within 30 days, prosecution and penalty for delay.

- Gratuity contribution: 4.81% of basic pay as per employment contract

- As per new Code of Wages 2019, the basic salary of employee cannot be less than 50% of his gross wages.

- Concept of fixed term employee under SS Code would be eligible even if the term is less than 5 years

- Secure gratuity liability through subscribing to group gratuity scheme of LIC or other insurance companies

Comp structure

For inclusion of labour benefits, comp structure is the first step

- The breakdown of salary (CTC/CTO) needs to be formally part of HR policy

- All benefits would be computed based on breakdown of comp

- Attempt should be to extend maximum reasonable benefits and protect take home as win-win situation.

- Ensure compliance of comp structure with laws is crucial

- Extreme care in preparing employment contracts including the comp structure

Budgeting for social security benefits

In charitable organization, it is important that the provisions of mandatory Labour compliances are kept in mind at the time of budgeting itself as it is not feasible for the organization to contribute for these compliances in absence of budget from own funds.

Points to be kept in Mind:

- Minimum Salary budgeted in the project should be Wages defined in Minimum Wages Act of State + 13% of EPF employer share (including administrative charges) + 3.25 % of ESI employer share + 15 days salary for gratuity benefit.

- Example: a field worker to be paid Rs. 8000 per month then the provision for his salary in budget should be Rs. 9,685/-

- Budgeting for grant proposals should be done accordingly

| Monthly Salary | 8,000.00 |

|

Employer Share of EPF 13 % (including admin charges) |

1,040.00 |

| Employer Share of ESI @ 3.25% | 260.00 |

| Gratuity (Monthly) | 385.00 |

| Cost to Organisation | 9,685.00 |

💲 These benefits are not provided by the donors separately in the budget therefore it is advisable that the salary provided in the budget should be on “Cost to Organization” principlele to ensure that these mandatory continuation can be paid.

🤝🏼 However if in exceptional cases it is not possible to provide these benefits to project staffs then their posts should not be included in the “Human Resource” cost.

💰 Instead the same should be budgeted as programme / field implementation cost and such person should be hired on consultancy on TOR basis and their payment should be made on deliverables basis and monthly invoice should be obtained against same.

📂 NO attendance register / leave records etc. should be maintained for these staffs. However for internal monitoring or control purpose separate records may be maintained.

Labour Codes

29 existing labour laws have been consolidated under four new codes, with an intent to amalgamate, simplify and rationalise the relevant provisions of the subsumed laws.

The Code on Wages, 2019

Amends and consolidates the laws relating to wages and bonus.Industrial Relations Code, 2020

Consolidates and amends the laws relating to trade unions, conditions of employment in industrial establishments, investigation and settlement of industrial disputes.The Social Security Code, 2020

Seeks to amend and consolidate the laws relating to social security with the goal to extend social security to everyone in organised, unorganised and any other sectors.Occupational Safety, Health & Working Conditions Code, 2020

Focussed on consolidating and amending the laws regulating the occupational safety, health and working conditions of the persons employed in an establishment.

The Code on Wages, 2019

The Code on Wages, 2019

- The Payment of Wages Act, 1936

- The Minimum Wages Act, 1948

- The Payment of Bonus Act, 1965

- The Equal Remuneration Act, 1976

Key impact areas

- Widened coverage

No wage threshold for employees, definition of employer includes ‘contractor’ and ‘legal representative of deceased employer’, Universal applicability - New definition of ‘wages’

Applicable to all employees; specified exclusions and conditional inclusions specified, cap on benefits in kind - Timeline for full and final settlement

Two days from the date of removal/resignation/retrenchment/dismissal. - Equal treatment of genders

No discrimination on the basis of gender in matters related to wages, recruitment and conditions of work - Payment of wages and deductions

Payment vide cheque, online mode; no unauthorised deductions allowed from the wages. Deduction not more than 50% of wages for specified matters. Wage slip - Floor wage

Central govt. to fix floor wage for different geographical areas and State govt. shall not fix the minimum wages less than the Floor wage. - Payment of Bonus

Appropriate Govt to decide. However, the likelihood of previous provisions to continue.

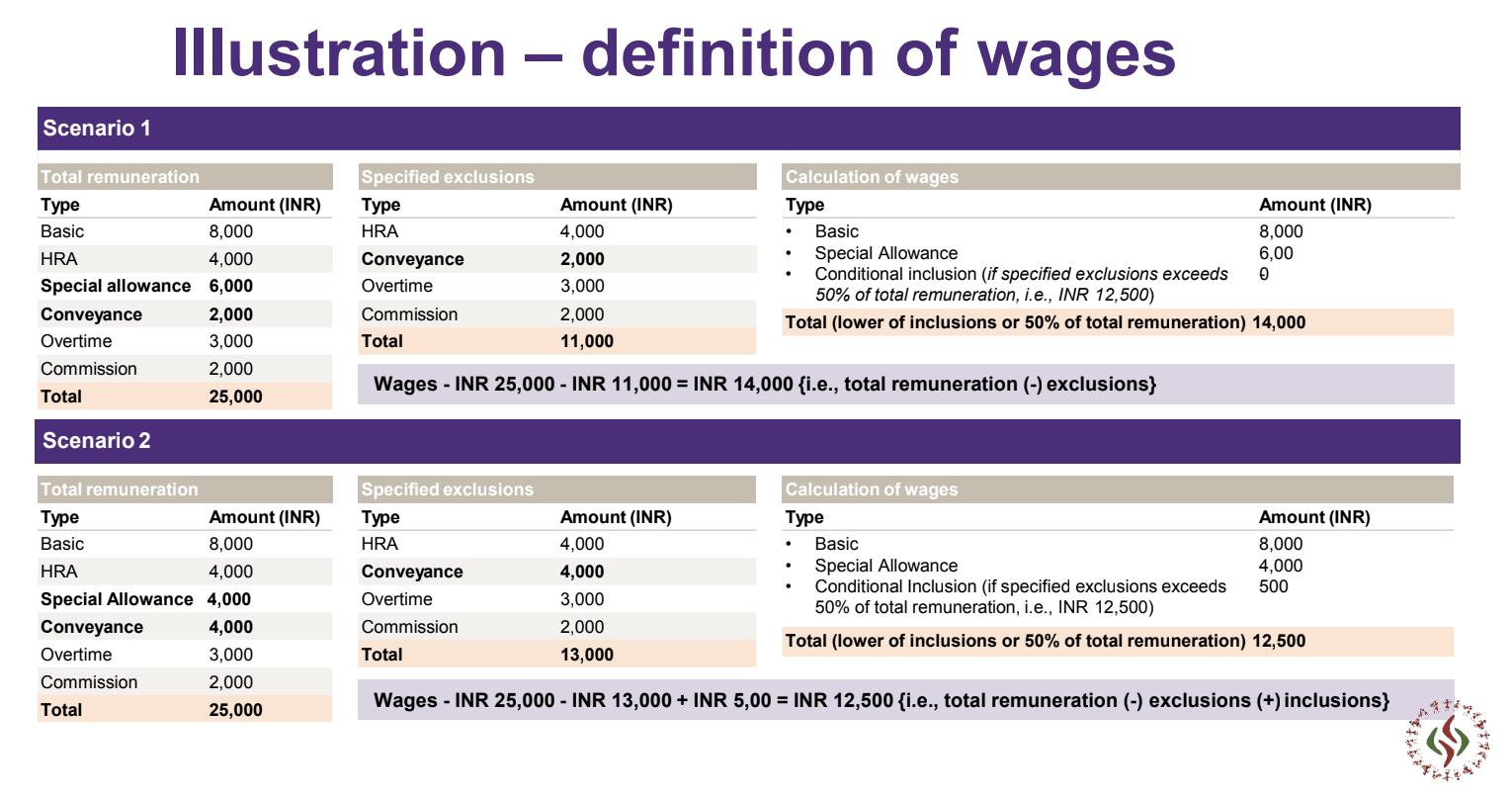

Definition of wages

|

Meaning and inclusions |

Exclusions |

|

Covers all remuneration payable by way of salaries, allowances or otherwise; expressed or capable of being so expressed in terms of money and includes:

|

Specified exclusions (11)

Specified exclusions capped at 50% of total remuneration (except gratuity and retrenchment compensation). |

|

Remuneration in kind to the extent it does not exceed 15% of total wages shall be included in wages. |

|

The Code on Social Security, 2020

Subsumed legislations

- The Payment of Gratuity Act, 1972

- The Employee’s Compensation Act, 1923

- The Employees' State Insurance Act, 1948

- The Employees' Provident Funds and Miscellaneous Provisions Act, 1952

- The Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959

- The Maternity Benefit Act, 1961

- The Cine-Workers Welfare Fund Act, 1981

- The Building and Other Construction Workers' Welfare Cess Act, 1996

- The Unorganised Workers' Social Security Act, 2008

Key impact areas

-

Coverage and registrations: Universal coverage for all working individuals envisaged-unorganised/individual. 20 EPF and 10 ESI Voluntary coverage – opt in/opt out. Limitation introduced as 5 years. ISMW defined.

-

Definition of wages: Wider definition, consistent with definition under Code on Wages, 2019

-

Introduction of new category of beneficiaries: Platform workers, gig workers, fixed-term employees, unorganised workers. 16-60 years, 90 days engagement in 12 months to be registered for SS benefit. Cost increase for aggregators.

-

Increase in quantum of gratuity payment:

-

New category of employees introduced i.e. ‘Fixed term workers’ rendering services for < 5 years versus open contract.

-

Principal employer liable to Gratuity payable to the contract labourers, in case of default by contractor. Gratuity besides PF and ESI.

-

-

Aadhaar Pre-requisite

-

Mandatory for registration, availing benefits.

-

Obligation on International Worker to obtain Aadhaar as per The Aadhar Act, 2016.

-

-

Transition provision: Schemes applicable till one year after Code is implemented, threshold limits to be specified/ notified by central government.

The Occupational Safety, Health and Working Conditions Code, 2020

Subsumed legislations

- The Factories Act, 1948

- The Plantations Labour Act, 1951

- The Mines Act, 1952

- The Working Journalists and other Newspaper Employees (CoS) & M P Act, 1955

- The Contract Labour (R&A) Act, 1970

- The Motor Transport Workers Act, 1961

- The Inter-State Migrant Workmen, Act 1979

- The Working Journalist Act, 1958

- The Beedi and Cigar Workers Act, 1966

- The Sales Promotion Employees Act,1976

- The Cine Workers and Cinema Theatre Workers Act, 1981

- The Dock Workers Act, 1986

- The BOCW Act, 1996

Key impact areas

- Registration and closure

Registration to be applicable if 10 or more workers. - Concept of core and non-core workers

Employment of contract labour in core activities of any establishment is prohibited (with certain exceptions) - Canteen and crèche facility

Mandated for specified establishments - Special provisions for women

Consent of female employees required for working before 6 am and after 7pm along with other safety measures - Leave rules and leave encashment

Workers can ask for encashment of leaves at end of year - Duties of Employees & Employers

Annual Health check up mandated for specified employees of specified establishments - Contractor / ISMW

Registration of contractors if they have 50 or more workers. Liability on principal employer if default by contractor Inter state migrant worker defined-10 or more with wages above Rs.18k per month

The Industrial Relations Code, 2020

Subsumed legislations

The Industrial Relations Code, 2020:

- The Trade Unions Act,1926

- The Industrial Disputes Act,1947

- The Industrial Employment (Standing Orders) Act, 1946

Key impact areas

- Concept of fixed-term employment

Introduced with benefits not be less than of a permanent worker - Conditions for strikes and lockouts prescribed

No strikes and lockouts without giving proper notice in compliance with the norms laid down in the code - Standing orders

Required in establishments where 300 or more workers are employed - Retrenchment, lay-off and closure provisions

Not to be applicable if workers are <300; lay-off related provisions will not be applicable if workers are <50 - Grievance redressal committee mandatory

To be set up where 20 or more workers employed, requires proportionate women representation - Recognition of Trade Unions

All possible efforts have been made in order to provide recognition to the Trade Unions in India. - Re-skilling Fund

Re-Skilling fund for retrenched employee

Please note: Information is for reference only. Read our disclaimer here.

No Comments