Code of Taxation

Charitable purpose and Types of charitable institutions under income tax

Types of entities that can register as charitable institutions in India

For charitable purpose, the following entities can be constituted:

- Trust

-

Society

-

Not for profit Company

While above entities have separate incorporation laws, the Income Tax law applies uniformly for all these entities.

Definition of Charitable purpose in Income Tax

Section 2(15) "charitable purpose" includes:

✓ Relief of the poor,

✓ Education,

✓ Yoga,

✓ Medical relief,

✓ Preservation of environment (including watersheds, forests and wildlife) and

✓ Preservation of monuments or places or objects of artistic or historic interest, and

✓ The advancement of any other object of general public utility:

Provided that the advancement of any other object of general public utility shall not be a charitable purpose, if it involves the carrying on of any activity in the nature of trade, commerce or business, or any activity of rendering any service in relation to any trade, commerce or business, for a cess or fee or any other consideration, irrespective of the nature of use or application, or retention, of the income from such activity, unless:

- Such activity is undertaken in the course of actual carrying out of such advancement of any other object of general public utility; and

- The aggregate receipts from such activity or activities during the previous year, do not exceed 20% of the total receipts, of the trust or institution undertaking such activity or activities, of that previous year;

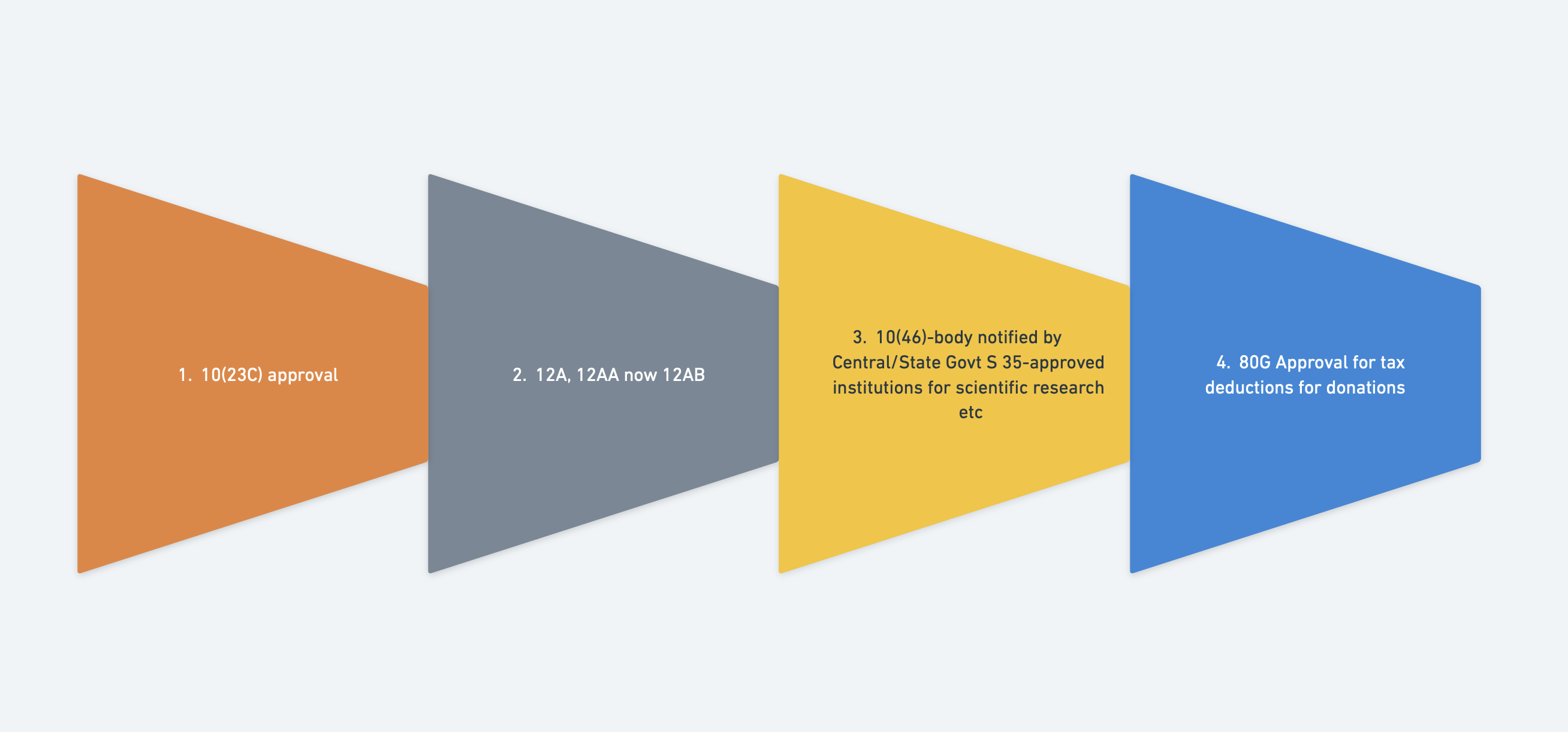

Illustrated:

- 10(23C) approval

- 12A, 12AA now 12AB

- 10(46)-body notified by Central/State Govt S 35-approved institutions for scientific research etc.

- 80G Approval for tax deductions for donations

Section 10(23C) entities

|

Section |

Non Approval |

Section |

Approval |

|

10(23C)(iiiab) |

Educational institution wholly/substantially financed by Govt |

10(23C)iv |

National Fund/Charitable institution of national importance |

|

10(23C)(iiiac) |

Medical institution wholly/substantially financed by Govt |

10(23C)v |

Religious institution or religious cum charitable institution notified by Govt |

|

10(23C)(iiiad) |

Educational institution gross receipts less than Rs.5 cr in a FY |

10(23C)vi |

Educational institution gross receipts more than Rs. 5 cr in a FY |

|

10(23C)(iiiae) |

Medical institution gross receipts less than Rs.5 cr in a FY |

10(23C)via |

Medical institution gross receipts more than Rs.5 cr in a FY |

2Two recent Landmark SC judgements in October 2022

-

10 (23C)(vi) entities should be solely (exclusively) for educational purposes, can undertake business activity incidental to the main object but not otherwise. Can generate surplus in course of pursuing main objects

-

For GPU entities, commercial activity only for advancement of GPU. Markup has to be reasonable for such commercial activity. The commercial activity should not be feeding charity

New scheme of Registration-latest update

New regime of registration for charitable organisations wef 1.4.2021

-

Re-registration/approval of charitable entities u/s 10(23C), 12A,35 and 80G approval for a period of 5 years, thereafter renewal once every 5 years. Perpetual registration abolished.

-

Department wants to have database and better control/monitoring on charitable institutions which has been fragmented and decentralised until now

Types of Approvals:

-

Re-registration/Revalidation of existing registered entities-5 years

-

Provisional registration for new entities-3 years

-

Regular registration for existing unregistered entities-5 years

-

Provisional to Normal registration for new entities- Total period 5 years

-

Modification of objects clause for 12A entities

-

If registered both under 10(23C) or 10(46) and 12A, then retain 10(23C) or 10(46) for 5 years

-

Renewal of registration after 5 years

New Regime and Forms

Coverage:

-

Re registration/re approval under 10(23C)/12A/80G-existing registered

-

Registration/re approval under 10(23C)/12A/80G-existing un-registered

-

Provisional registration under 10(23C)/12A/80G-new entities

-

Statement of donation u/s 80G

-

Receipt/Certificate of donation u/s 80G

Forms:

-

10A-Re-registration and provisional registration

-

10AC-Approval of 10A by CIT

-

10AB-Registration of existing unregistered entities, conversion of provisional to normal registration, Renewal, change in objects and one of the two registrations made inoperative.

-

10AD- Approval of 10AB by CIT

-

10BD-Statement of donations u/s 80G

-

10BE-Receipt of donation u/s 80G

Action for existing registered entities

-

Common Form 10A for 10(23C), 12AA, 80G, 35 entities-select code for respective sections e.g. 01 for 12A and 11 for 80G.

-

Submission date-30.9.2023 vide CBDT circular 6 of May 2023

-

CIT order within

6 (earlier 3)3 monthsfromafterendmonth ofquarterapplication in 10AC Form. Registration valid for 5years.No inquiry, instantly granted.years -

UptoNo30.6.2024,inquiry.condonation10A-not completely filled, CIT may cancel after giving opportunity ofdelaybeingwas granted through CBDT circulars from time to time.heard WEF 1.10.2024, for condonation of delay in filing under 12A(1)(ac) i.e. reregistration, renewal,object modification, registration by unregistered entities, conversion of provisional to regular,inoperative clause, application to PCIT/CIT showing reasonable cause for delay. Provision activatedin Form 10AB

Renewal of 12AB registration and 80G approval of existing registered entities

- Renewal in Form 10AB after 5 years within 6 months

beforeof expiryof 5 yearsand after due inquiry process Most12ABIf registered entity missed due date and

80G registration have been issued upto AY 26-27. Som renewal application in 10AB have to be filed by 30th Sep 2025 separately for 12AB and 80G.Renewal will be in Form 10AD for both 12Ab and 80G.In Finance Act 2025, Small NGOs i.e. where income is less than Rs. 5 cr in previous 2 years preceding the year in which renewal application is made will get 12AB registration for 10 years instead of 5 years. Not applicable for 80G approval andapplied for provisional registration, it can surrender and apply for regular registrationbyinunregistered10Ainstitutionsuptowhich30.9.23remains as 5 years. Applicable from 1.4.2025

Action for existing un-registered entities

Existing unregistered entities:

- Apply only in Form 10AB upto 30.9.23 provided no exemption claimed earlier.

Others:

- All pending applications rejected due to missing the due date would be considered valid.

- Entities to be treated unregistered for section 115TD post 30.9.23

Action for Provisional 12Ab Registration & 80G approval

- Effective from the previous year relevant to assessment year from which the said registration is sought. Applicable only when charitable activity not

commencedcommended as confirmed in 10A and10AB.10AB - Form

charitable entities debarred from provisional registration route.10A - CIT approval

in Form 10ACwithin6 (earlier 1)1 month from the end ofquartermonth in which application was made. No inquiry - Validity 3 years, convert to normal registration within 6 months of commencement of charitable activities or 6 months before expiry of provisional registration whichever is earlier.

- For

conversion to regularnormal registration, Form 10AB. Due process of inquiryand registration period 5/10 years

Accreted Income or Exit Tax-Section 115TD of IT Act (1.6.2016)

Accreted income is excess of fair market value of assets over total liabilities of Trust. Accreted income is taxed at MMRConditions when 115TD triggered:12AB registration cancelledModification of objects not applied for regn/not in line with condition of registration and application rejectedMerged into an entity not with similar objects and not registered under 12ABfailure to transfer assets upon dissolution to another 12AB/10(23C) entity within 12 monthsNewly added: non registration, non renewal, non conversion of provisional to regular registration wef 1.10.24

Merger of charities with same/similar objects-new section 12AC specifying situationsof merger when accreted tax will not be applicable effective 1.4.2025

Department’s power to cancel registration

Power to cancel registration for Specified Violations i.e.

spent income for other than objectbusiness income not incidental and no separate booksprivate religious purpose, particular religious community/casteviolation of other laws which affect achievement of objectivesbenefits u/s 13 (not reasonable)section 11(5) non complianceconditions not complied specified in registration certificate (Form 10AC).

Reference by AO to CIT/PCIT who shall pass order within 6 months from quarter in which notice was issued.

Conditions of registration as per 10AC-12AB

Alter object/rules with prior approval of CIT and effective after approvalOn dissolution, surplus assets to institution with similar object and no asset to specified personsMerged or converted to non charitable entity will attract 115TD12AB registration does not entitle automatic 80G benefit12AB registration subject to fulfilling conditions under section 11 and 12-conditionalChange in constitution document should not result in questioning charitable statusMaintain accounts, separate accounts for incidental business, file ITRChange of registered office outside jurisdictional CIT with prior approvalRegistration cancelled if activities are not genuine, not as per object or registration obtained fraudulentlyNo benefit under s197 based on 12AB registrationVoluntary contribution through bank account whose number should be with the CITEntity to comply with provisions of IT Act and Rules12AB registration is instantly granted, if later it is found information not complete (deleted by Finance Act 2025), false etc, URN will be automatically granted as through it was never issued.

Conditions of registration as per 10AC-80G

Change in deed/bye-laws shall be affected after due procedure and approval of the Competent Authority as per law and intimation to DepartmentAny change in the trustees or address shall be intimated to DepartmentMaintain books of accounts as prescribed and also get them audited as per the provisions of section 80G(5)(iv) read with section 12A(1)(b)/10(23C) of the Income Tax Act,1961.Certificate of donation shall be issued to the donor in form no 10BENo cess/fee/consideration shall be received in violation of section 2(15)File return of income of trust/society/non profit company as per section 139(1)/(4A)/(4C) of IT ActApply to donations only if applicant is established in India for charitable purpose, fulfils the conditions laid down in section 80G(5) of the Income Tax Act, 1961 and the religious expenditure does not exceed the limit specified in section 80G(5B) of the said Act.If the applicant derives any income, being profits and gains of business, it shall maintain separate books of account as provided in section 80G(5)(i) of IT Act. Donation shall not be used, directly or indirectly, for the purposes of such business and a certificate shall be issued to every person making a donation that the applicant maintains separate books of account in respect of the business and the donation received by it will not be used for the purpose of the business.The approval and the Unique registration number has been instantly granted and if application is fully or partly incomplete (deleted by Finance Act 2025) or by providing false/ incorrect information or documents required to be provided under section 11, the Unique Registration Number (URN) shall be cancelled and deemed to have never been granted.

Anonymous donation-Section 115BBC of IT Act

For charitable trust, if name and address of donor is not known, it is anonymous donation.Not applicable to Religious Truss or charitable cum religious trust except where the donation is for an educational or medical institutionTax payable 30%. Threshold: Rs.1 lakhs or 5% of total donation received whichever is higher.

Section 80G:80G

Statement of donation

- 80G provisions: Cash donation upto Rs.2k permitted, not in kind and only through banking channels. No anonymous donation permitted u/s 80G

80GFormdeduction-100%/50% with or without qualifying limit i.e. subject10BD-points to10% of adjusted Gross Taxable income. Donation to charitable institutions falls under 50% with qualifying limit.80GGA deduction-100% for donation for scientific research and rural development projectsForm 10BD-Statement of Donation provided approved under 80Gremember:

- Donation type:

- Corpus

- Specific

- Others

- UIN of donor-PAN, Aadhar

- If PAN / Aadhaar is not available then either the passport No. /Elector’s photo

identity/identity / Driving License/ Ration Card/Taxpayer identification Number where the person resides outside India. - Mode of receipt-cash, kind, electronic and cheque, others

- File by 31st May for each

FY. Fee andFY - Penalty for delayed filing

Section 80G approval can be applied even if charitable status benefit taken which was not allowed earlier-effective 1.10.2024

Receipt/certificate of donation

-

Form 10BE

-

31stImmediateMayissueforafterpreviousfilingfinancial year10BD -

Linked to UIN of donor

-

Penalty for delay

-

Generation and download of donation receipt from web portal after filing 10BD

-

Issue the system generated 10BE only to

donordonors for claiming 80G benefit.

Code of Taxation for Charitable Institutions

Chapter III-Incomes which do not form part of total income

|

1. |

Section 11 Income from property held under trust for charitable or religious purposes. |

|

2. |

Section 12 Income of trusts or institutions from voluntary contributions for charitable and relgious purposes. Section 12A – Conditions for applicability of sections 11 and 12 Section 12AA – Procedure for Registration-repealed Section 12AB – Procedure for Registration under new regime |

|

3. |

Section 13 Section 11 not to apply in certain cases. |

Section 11

Income from property held for charitable or religious purposes

Section 11(1): theThe following income shall not be included in the total income of the previous year of the person in receipt of the income—income:

-

Income derived from property held under trust wholly for charitable or religious

purposes,purposes, to the extent to which such income is applied to such purposes inIndia;India;andand, where any such income is accumulated or set apart for application to such purposes in India, to the extent to which the income so accumulated or set apart is not in excess of fifteenper centpercent of the income from such property; -

Income in the form of voluntary contributions made with a specific direction that they shall form part of the corpus of the trust or

institutioninstitution.and provided it is deployed in Section 11(5) modes of investment .

Deemed Application-1 year

As per clause (2) of Explanation to section 11(1):

If, in the previous year, the income applied to charitable or religious purposes in India falls short of eighty-five per cent of the income derived during that year from property held under trust, or, as the case may be, held under trust in part, by any amount—

- for the reason that the whole or any part of the income has not been received during that year, or

- for any other reason,

Then at the option of the person in receipt of the income (such option to be exercised before the expiry of the time allowed under sub-section (1) of section 139 for furnishing the return of income in form -9A), be deemed to be income applied to such purposes during the previous year in which the income was derived.

Note: If DAthe amount accumulated as per clause (2) of Explanation to section 11(1) is not utilizedutilised in the next year then the amount accumulated will be taxable income.

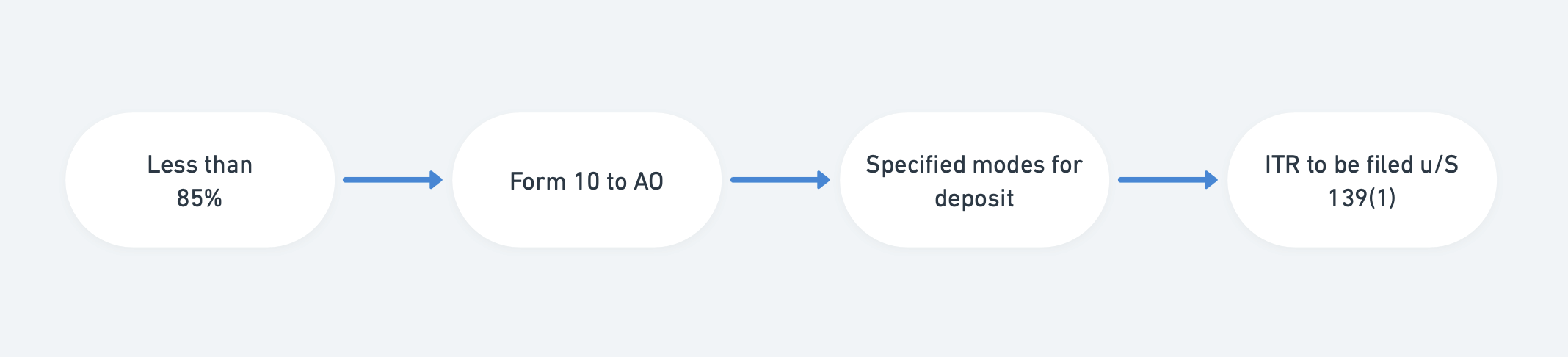

Accumulation: Accumulation-5 years

As per section 11(2):

If, in the previous year, the income applied to charitable or religious purposes in India falls short of eighty-five per cent of the income derived during that year from property held under trust, but is accumulated or set apart, either in whole or in part, for application to such purposes in India, such income so accumulated or set apart shall not be included in the total income of the previous year of the person in receipt of the income, provided the following conditions are complied with, namely:

-

suchSuch person furnishes a statement in the prescribed form (Form 10) and in the prescribed manner (Online) to the Assessing Officer, stating the purposeand periodfor which the income is being accumulated or set apart and the period for which the income is to be accumulated or set apart, which shall in no case exceed fiveyears (not applied amount taxable in 5th year alone);years; -

theThe money so accumulated or set apart is invested or deposited in the forms or modes specified in sub-section (5) and utilised for the purpose for which accumulated -

Not transferred to an entity covered under Section 12A of the Act

-

FormThe10statement referred to in clause (a) is furnished on or before the due date specified under sub- section (1) of section 139(1)for furnishing the return of income for the previous year. Repurposing of accumulation can be permitted by the Department.

Illustrated: Less than 85% ➡️ Form 10 to AO ➡️ Specified modes for deposit ➡️ ITR to be filed u/S 139(1)

Section 11(4)

Business income of charitable institution

-

(4) For the purposes of this section "property held under trust" includes a business undertaking so held, and where a claim is made that the income of any such undertaking shall not be included in the total income of the persons in receipt thereof, the Assessing Officer shall have power to determine the income of such undertaking in accordance with the provisions of this Act relating to assessment; and where any income so determined is in excess of the income as shown in the accounts of the undertaking, such excess shall be deemed to be applied to purposes other than charitable or religious purposes.

-

(4A) Sub-section (1) or sub-section (2) or sub-section (3) or sub-section (3A) shall not apply in relation to any income of a trust or an institution, being profits and gains of business, unless the business is incidental to the attainment of the objectives of the trust or institution, and separate books of account are maintained by such trust or institution in respect of such business.

Section 11(5)

Modes of investment

The forms and modes of investing or depositing the money referred to in clause (b) of sub- section (2) shall be the following, namely:

-

Investment in savings certificates as defined in clause (c) of section 2 of the Government Savings Certificates Act, 1959 (46 of 1959), and any other securities or certificates issued by the Central Government under the Small Savings Schemes of that Government;

-

Deposit in any account with the Post Office Savings Bank

-

Deposit in any account with a scheduled bank or a co-operative society engaged in carrying on the business of banking (including a co-operative land mortgage bank or a co-operative land development bank)

-

Investment in units of the Unit Trust of India established under the Unit Trust of India Act, 1963 (52 of 1963)

-

Investment in any security for money created and issued by the Central Government or a State Government

-

Investment in debentures issued by, or on behalf of, any company or corporation both the principal whereof and the interest whereon are fully and unconditionally guaranteed by the Central Government or by a State Government

-

Investment or deposit in any public sector company:

-

Deposits with or investment in any bonds issued by a financial corporation which is engaged in providing long- term finance for industrial development in India and which is eligible for deduction under clause (viii) of sub- section (1) of section 36

-

Deposits with or investment in any bonds issued by a public company formed and registered in India with the main object of carrying on the business of providing long-term finance for construction or purchase of houses in India for residential purposes and which is eligible for deduction under clause (viii) of sub-section (1) of section 36;

-

Deposits with or investment in any bonds issued by a public company formed and registered in India with the main object of carrying on the business of providing long-term finance for urban infrastructure in India

-

Investment in immovable property.

Further additions to 11(5)

Additional as per Rule 17C (March 2018)

-

Investment in units of any scheme of a mutual fund

-

Deposit with authority for low cost housing

-

Stock certificate of Sovereign Gold Bonds

-

Debt instruments of infrastructure finance company

-

Acquiring shares of NSDC,

DepositoryDepository.

Example of Computation

|

Case 1 |

|

|

Income derived from property held under trust wholly for charitable purposes |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-850 |

|

Less: Accumulation under section 11(1)(a) No Specific Form |

-150 |

|

Taxable Income |

NIL |

|

Case 2 |

|

|

Income derived from property held under trust wholly for charitable purposes |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-600 |

|

Less: Accumulation under section 11(1)(a) No Specific Form |

-150 |

|

Less: Accumulation under section (11) (2): Form 10, Specific Purpose |

-250 |

|

Taxable Income |

NIL |

|

Case 3 |

|

|

Income derived from property held under trust wholly for charitable purposes (Rs 200 was received in March) |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-650 |

|

Less: Accumulation under section 11(1)(a) No Specific Form (15% of 1000) |

-150 |

|

Less: Accumulation as per clause (2) of Explanation to section 11(1), Form 9 |

-200 |

|

Taxable Income |

NIL |

Disallowance of Cash/bearer Payments

Section 40(A)(3) provides that “Where the assessee incurs any expenditure in respect of which a payment or aggregate of payments made to a person in a day, otherwise than by an account payee cheque drawn on a bank or account payee bank draft or use of electronic clearing system through a bank account [or through such other electronic mode as may be prescribed], exceeds Ten Thousand Rupees, no deduction shall be allowed in respect of such expenditure”.

Note:

- The expenditure as disallowed above, will be taxed @

30%31.2% at the time of filing the Income Tax Return. - The cash payments made by staffs and reimbursed by organisation shall also be treated as cash

paymentpayment. - Disclose non-compliances in ITR, if same noticed by Assessing Office during Income Tax Assessment, additional penalty and

interestinterests may also be levied. - Exceptions in Rule

60D60D.

Disallowance for Non Deduction of Tax at Source

Section 40(a)(ia) provides that 'Where the assessee fails to deduct the whole or any part of the tax in accordance with the provisions of Chapter XVII-B then the amount equal to 30% of expenditure shall not be allowed at the time of computation of Income’

Note:

-

The expenditure as disallowed above, will be taxed @

30%31.2% at the time of filing the Income Tax Return. -

Disclose non-compliances in ITR, if same noticed by the Assessing Office during Income Tax Assessment,

additional penalty andinterestinterests may also be levied.

Example of Computation

|

Case 4 |

|

|

Income derived from property held under trust wholly for charitable purposes |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-650 |

|

Less: Accumulation under section 11(1)(a) No Specific Form (15% of 1000) |

-150 |

|

Less: Accumulation under section (11) (2): Form 10, Specific Purpose |

-200 |

|

Add: Expenditure disallowed under section 40 and 40A (30% Expenditure) |

30 |

|

Taxable Income 30 |

30 |

|

Tax on Income @ 30% |

9 |

|

Add: Surcharge @ 4% |

0.36 |

|

Total Tax Liability |

9.36 |

Section 12

Income of trust/ institution from Contribution

Section 12 (1):

Any voluntary contributions received by a trust created wholly for charitable or religious purposes or by an institution established wholly for such purposes (not being contributions made with a specific direction that they shall form part of the corpus of the trust or institution) shall for the purposes of section 11 be deemed to be income derived from property held under trust wholly for charitable or religious purposes and the provisions of that section and section 13 shall apply accordingly.

Section 12 (2):

The value of any services, being medical or educational services, made available by any charitable or religious trust running a hospital or medical institution or an educational institution, to any person referred to in clause (a) or clause (b) or clause (c) or clause (cc) or clause (d) of sub-section (3) of section 13, shall be deemed to be income of such trust or institution derived from property held under trust wholly for charitable or religious purposes during the previous year in which such services are so provided and shall be chargeable to income-tax notwithstanding the provisions of sub-section (1) of section 11

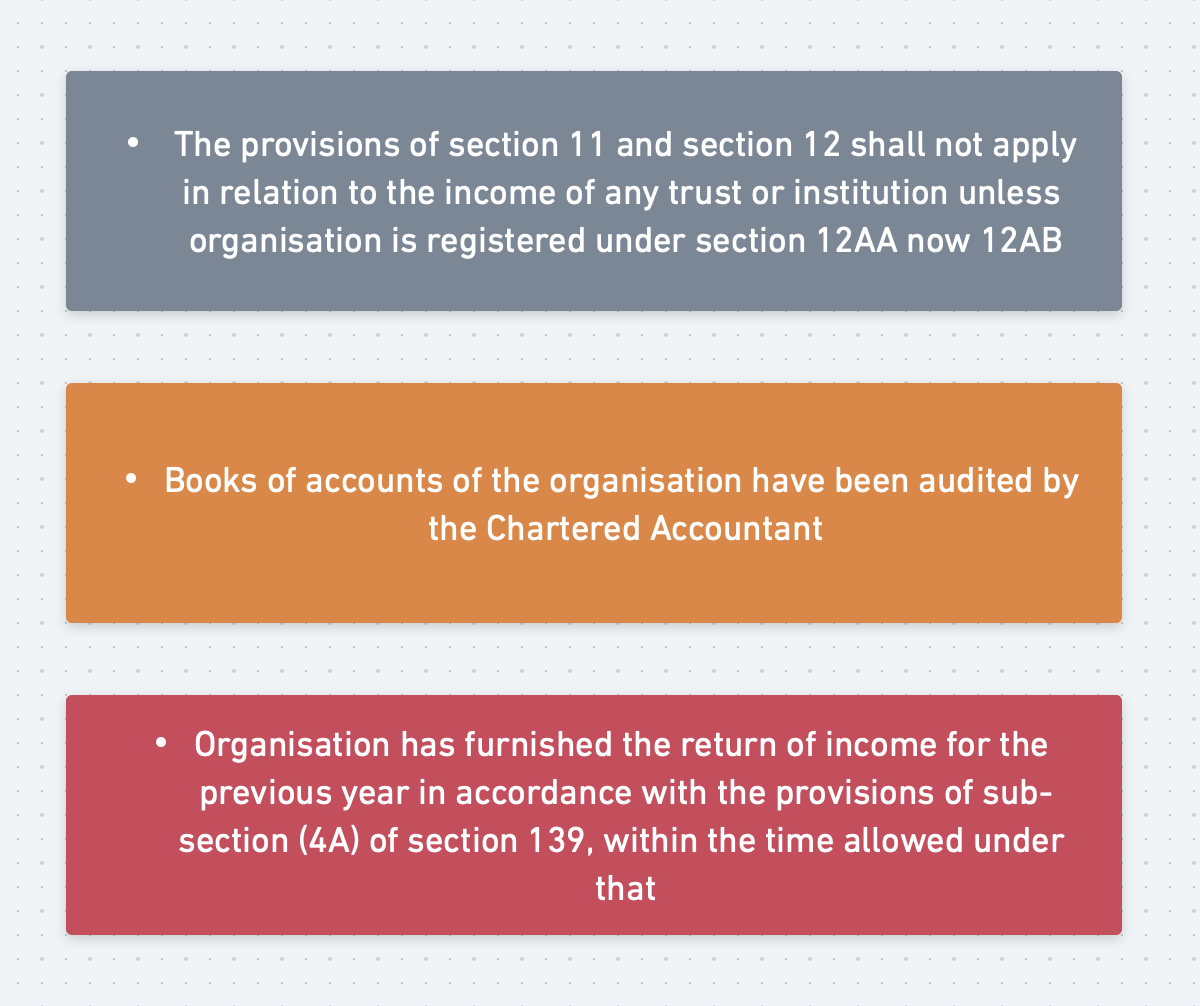

Section 12A

Conditions for Applicability of Section 11 & 12

Illustrated:

- The provisions of section 11 and section 12 shall not apply in relation to the income of any trust or institution unless organisation is registered under section 12AA now 12AB

- Books of accounts of the organisation have been audited by the Chartered Accountant

- Organisation has furnished the return of income for the previous year in accordance with the provisions of sub-section (4A) of section 139, within the time allowed under that

Section 13

Section 13 of Income Tax

Section 13(1):

Section 11 not to apply when:

-

Trust for private religious purposes which does not ensure for the benefit of the public.

-

Trust for charitable purposes or a charitable institution created or established after the commencement of this Act, any income thereof if the trust or institution is created or established for the benefit of any particular religious community or caste.

-

If such trust or institution has been created or established after the commencement of this Act and under the terms of the trust or the rules governing the institution, any part of such income ensures, directly or indirectly for the benefit of any person referred to in sub-section (3).

-

If any part of such income or any property of the trust or the institution (whenever created or established) is during the previous year used or applied, directly or indirectly for the benefit of any person referred to in sub-section (3).

-

Non compliance of Section 11(5)-permitted modes of investment

Section 13(6):

The exemption under section 11 or section 12 shall not be denied in relation to any income, other than the income referred to in sub-section (2) of section 12, by reason only that such trust has provided educational or medical facilities to persons referred to in sub section 3.

Section 13(3)

List of persons:

Section 13(2):

The income or the property of a trust deemed to have been used or applied for the benefit of a person referred to in 13(3)

-

If any part of the income or property of the trust or institution is, or continues to be, lent to any person referred to in sub-section (3) for any period during the previous year without either adequate security or adequate interest or both.

-

If any land, building or other property of the trust or institution is, or continues to be, made available for the use of any person referred to in sub-section (3), for any period during the previous year without charging adequate rent or other compensation;

-

If any amount is paid by way of salary, allowance or otherwise during the previous year to any person referred to in sub-section (3) out of the resources of the trust or institution for services rendered by that person to such trust or institution and the amount so paid is in excess of what may be reasonably paid for such services;

-

If the services of the trust or institution are made available to any person referred to in sub-section (3) during the previous year without adequate remuneration or other compensation;

-

If any share, security or other property is purchased by or on behalf of the trust or institution from any person referred to in sub-section (3) during the previous year for consideration which is more than adequate;

-

If any share, security or other property is sold by or on behalf of the trust or institution to any person referred to in sub-section (3) during the previous year for consideration which is less than adequate

-

If any income or property of the trust or institution is diverted during the previous year in favour of any person referred to in sub-section (3)

ComputationFinance Act 2023

Amendments for exemptioncharitable entities

DetermineIncome-commercialApplication

sense/bookmadeincome,from corpus funds or through loans and borrowings only if replenished/repaid in 5 years-

Retrospective section 11 exemption benefit withdrawn

-

Inter charity donations of local funds-85% of amount as application

-

Exemption benefit not

asavailableperforheadsUpdated IT Return -

Timeline for filing Form 9A and 10

-

No provisional registration for existing unregistered entities

-

Exit tax in case of

incomenonbutrenewal, non re registration or not converting provisional to normal registration -

Incorrect or incomplete information in Form 10A a specified violations inviting cancellation of registration

Finance Act 2022

Amendments for charitable entities

-

Monitoring and effective implantation:

- Proper book of accounts to be maintained for 12AB and 10(23C) entities-form, manner and place as

permay be prescribed. - Power to cancel registration for specified violations i.e. spent income for other than object, business income not incidental and no separate books, private religious purpose, particular religious community/caste, violation of other laws, benefits u/s 13, not reasonable, section 11(5) non compliance, conditions not complied specified in registration certificate (Form 10AC). Reference to be made by AO for passing order by CIT/PCIT who shall pass order cancelling or refusing within 6 months from quarter in which notice was issued.

-

Consistency in 2 regimes with a view to have one regime in future:

-

Accumulation of income-not spent in 5 years or taxed in 5th year itself, not 6th year and applicable to 10(23C) entities also. Delay due to court injunction etc, the period will be excluded in calculating the accumulation period. Repurposing of accumulation can be permitted by the Department.

-

10(23C) IT return and books of

accountaccounts for 12 A entities. ReduceApplication115TD

ofapplicable to 10(23C) entities also.

-

Clarity:

-

Tax @30% (S. 115BBI) on denied income for

charitable13(1)© andreligious13(1(d)purposeviolations.basedPenaltyonforcommercialprovidingsenseunreasonable Reduce 15% of remaining incomeIn case income still remaining, thenOpt to spend income in subsequent yearOpt to accumulate income upto 5 years

Applicability of incidental business income and proviso to section 2(15)Tax attracted if option in a and b not fulfilledBenefitbenefits to specifiedpersonspersons- s 271AAE penalty equal to amount of benefit in first year and twice for subsequent yearFundsput in specified modes of investment-corpus and AccumulationProvision cannot be claimed as application, actual spend/payment only is application.

ApplicationmadeVC received by religious institutions for repair and maintenance of religious institutions treated as corpus and not treated as income even without specific direction from

corpusthefundsdonororfromthroughFY 20-21 but should be invested in specified modes-

Newly inserted section 13(10) & 13(11)-Computation of taxable income due to specified non compliance i.e. books of accounts, non filing ITR, Audit report, commercial receipts in excess of 20%. Claim admissible revenue expenditure from income subject to expenditure not from corpus, loans and

borrowingsborrowings,eligible onlydepreciation ifreplenished/repaidcostinclaimed,5donationyearsto other organisations and after disallowing 40A(3) and 40(a)(ia) cases. Beneficial since entire income is not taxed

Finance Act 2021

Amendments for charitable entities

Intercharity donationsUse of

localCorpusfunds-85%nooflongeramountapplication : Application for charitable or religious purposes from the corpus fund shall not be treated as application of income for charitable or religious purposes. Provided that the amount not so treated as application, or part thereof, shall be treated as application for charitable or religious purposes in the previous year in which the amount, or part thereof, is invested or deposited back, into one or more of the forms or modes specified in sub-section (5) maintained specifically for such corpus, from the income of that year and to the extent of such investment or deposit.-

Exclusion of Corpus Fund from Income (conditional): Any Voluntary Contribution made with a specific direction that they shall form part of the corpus of the trust or institution shall not be included in the total income of such trust or institution unless such voluntary contribution is invested or deposited in one or more of the forms or mode specified in the act.

-

Use of Loans / Borrowings no longer applies except during repayment : Any expenditure made for charitable or religious purpose out of loan or borrowing shall not be treated as application for charitable or religious purpose. Provided such amount shall be treated as application for charitable or religious purposes at the time of repayment of such loan.

-

Carry forward of

previous years deficitLosses notallowedallowed: Calculation of income required to be applied or accumulated during the previous year shall be made without any set off or deduction or allowance of any excess application of any of the year preceding the previous year

Maintaining Books of accounts for NGOs

-

There was no regulation regarding books of accounts by NGOs upto FY 21-22

-

Section 12A(1)(b)(i) inserted for maintaining of books of accounts and other documents wef AY 23-24.

-

Not applicable if total income is below threshold chargeable to tax.

-

Rule 17AA inserted from 10.8.2022 providing for four sub rules

1. Books of accounts & other documents:

- documents

The specified books of accounts shallincludeinclude:-

cash book

-

ledger

-

journal

-

copies of serially numbered receipts, original copy of invoices, etc

Other documents include:

-

-

Record of all the projects and institutions run by the organisation

-

Record of income of the organisation during the previous year

- voluntary contribution containing details of name of the donor, address, permanent account number (if available) and Aadhaar number (if available);

- income from property held under trust referred to under section 11 of the Act along with list of such

propertiesproperties;(III) - income of trust other than the contribution referred in items (I) and (II)

- Record of application out of the income during the year

- application of income in India, containing details of

amount;amount of application; name and address of the person to whom any credit or payment is made and the object for which such application is made, amount credited or paid - application of income outside India, containing details of amount of application, name and address of the person to whom any credit or payment is made and the object for which such application is made;

- deemed application of income referred in section 11(1) of the Act containing details of the reason for availing such deemed application;

- income accumulated or set apart as per section 11(2) containing details of the purpose for which such income has been accumulated;

- money invested or deposited in the forms and modes specified in 11(5)

- money invested or deposited in the forms and modes other than those specified in 11(5)

- application of income in India, containing details of

-

Record of specified application out of the income of preceding years

-

Record of voluntary contribution with a specific direction to form Corpus

- the contribution received containing details of name of the donor, address, permanent account number and Aadhaar number;

- application out of such voluntary contribution referred to in item (I) containing details of amount of application, name and address of the person to whom any credit or payment is made and the object for which such application is made; amount credited or paid towards corpus to 12AB or 10(23C) institution;

- the forms and modes specified in section

11 (11(5) of the Act in which such voluntary contribution, received during the previous year, is invested or deposited; - money invested or deposited in the forms and modes other than those specified in 11(5)

-

Record of contribution received under 80G(2)(b) being treated as corpus

-

Record of Loans and Borrowings

- information regarding amount and date of loan or borrowing, amount and date of repayment, name of the person from whom loan taken,

address of lender, permanent account number and Aadhaar number (if available) of the lender; - application out of such loan or borrowing containing details of amount of application, name and address of the person to whom any credit or payment is made and the object for which such application is made;

- application out of such loan or borrowing, received during any previous year preceding the previous year, containing details of amount of application, name and address of the person to whom any credit or payment is made;

- repayment of such loan or borrowing (which was applied during any preceding previous year and not claimed as application) during the previous

yearyear.

- information regarding amount and date of loan or borrowing, amount and date of repayment, name of the person from whom loan taken,

-

Record of properties held by the

assesseassessee- immovable properties containing details

ofof,- nature, address of the properties, cost of acquisition of the asset,

registration documents of the asset; - transfer of such properties, the net consideration utilised in acquiring the new capital asset;

- nature, address of the properties, cost of acquisition of the asset,

- (

II)movable properties including details of the nature and cost of acquisition of the asset

- immovable properties containing details

-

Record of specified persons, as per section 13 (3) of the Act

- containing details of their name, address, permanent account number and Aadhaar number(if available);

- transactions undertaken with specified persons under 13(3) containing details of date and amount of such transaction, nature of the transaction and documents to the effect that such transaction is, directly or indirectly, not for the benefit of such specified

personperson.

-

Any other

document

- Form of keeping books of accounts and documents: Kept in written form or electronic form or digital form or print-outs of data stored in electronic form or in digital form or any other form of electromagnetic data storage device.

3. Place of maintaining books of accounts and other documents: shall be kept and maintained at its "registered office“. If the accounts are maintained other than the registered office or at various project locations, intimate

sessingassessing Officer in writing, giving full address of the other places supported by resolution of the board4. Period for which books of accounts & other documents should be kept: Kept and maintained for a period of ten years from the end of the relevant assessment year

-

Organisation having income subject to section 11(4) and 11(4)(a) to maintain a separate set of books of account of such income in line with the provision under Income Tax Act.

Maintaining Books of accounts for NGOs

-

2.

Implication of Non-Maintenance of Books of Account:Account.

Section 13(10) and (11) inserted wef AY 22-23 stating that Income chargeable to tax shall be computed after allowing a deduction for

expenditure incurred for the objects of the institution as specified in this section subject to fulfilment of the following conditions, namely:

-

Such expenditure is not from the corpus standing to the credit of such trust or institution

-

Such expenditure is not from any loan or borrowing;

-

Claim of depreciation is not in respect of an asset, acquisition of which has been claimed as an application of income

in the same or any other previous year; and -

Such expenditure is not in the form of any contribution or donation to any person.

-

Such expenditure violating section 40(3) and 40(a)(ia) disallowed

expenditureCarry forward of loss and expenditure/decurion not allowed except under the Code from section 11-13.

Income Tax Bill 2025

Provision for Charitable institutions

The Bill introduces the term “Registered Nonprofit Organization” (Registered NPO) as a unified definition for all charitable entities i.e. society, Trust, S8, Univ etc.

Consolidation of Provisions for NPOs into a Single Chapter: Chapter 17B-Special Provisions for Registered NPOs-(Clause 332-355). This chapter is divided into seven structured subparts:

Registration – Application timelines, conditions for approval, and validity of registration.Income Computation – Rules regarding taxability and accumulation of income.Commercial Activities – Limitations on NPOs engaging in profit-generating activities.Compliance Requirements – Filing of tax returns, audit requirements, and disclosures.Penalties and Violations – Consequences for non-compliance.Deductions for donations under Section 133 (erstwhile 80G) – Regulations governing tax deductions on donations to NPOs.Interpretation – Definitions and explanations of key terms used in the chapter.

Changes in Taxability and Compliance Requirements: Under the current tax law, provisions related to the taxability of NPOs’ income are spread across multiple sections, such as:

Section 115BBC – Taxability of anonymous donations.Section 115BBI – Taxability of certain specified income etc. The Bill consolidates these provisions under a single framework.

Simplified Application of Income Provisions: The Existing Section 11 provisions regarding the application of income are complex due to multiple explanations and cross-references. The new bill consolidates all application-related provisions in one section, making it easier to determine:

What qualifies as an eligible application of income.The conditions required for the application of income to be tax-exempt.Treatment of funds applied from capital corpus and their replenishment.

Elimination of Deemed Application Concept: The new bill removes the deemed application concept for shortfall in 85% application out of income.

Enhanced Accumulation Provisions: Bill eliminates restrictions on the purpose of accumulation for five-year accumulation . Nonprofits can now accumulate funds for any objective within their registered mandate.

Anonymous donation provision not applicable now only to religious institutions15% income set apart is now called Deemed accumulated income and is to be invested in specified modes of investmentRegular income has been defined to include receipts for charitable activity, voluntary contribution, incidental business incomeApplication from corpus, loans and borrowings, deemed accumulated income etc not applicationDelay in Audit report is not specified non-compliance

Please note: Information is for reference only. Read our disclaimer here.