Code of Taxation (2023)

Types of entities that can register as charitable institutions in India

For charitable purpose, the following entities can be constituted:

- Trust

-

Society

-

Not for profit Company

While above entities have separate incorporation laws, the Income Tax law applies uniformly for all these entities.

Definition of Charitable purpose in Income Tax

Section 2(15) "charitable purpose" includes:

✓ Relief of the poor,

✓ Education,

✓ Yoga,

✓ Medical relief,

✓ Preservation of environment (including watersheds, forests and wildlife) and

✓ Preservation of monuments or places or objects of artistic or historic interest, and

✓ The advancement of any other object of general public utility:

Provided that the advancement of any other object of general public utility shall not be a charitable purpose, if it involves the carrying on of any activity in the nature of trade, commerce or business, or any activity of rendering any service in relation to any trade, commerce or business, for a cess or fee or any other consideration, irrespective of the nature of use or application, or retention, of the income from such activity, unless:

- Such activity is undertaken in the course of actual carrying out of such advancement of any other object of general public utility; and

- The aggregate receipts from such activity or activities during the previous year, do not exceed 20% of the total receipts, of the trust or institution undertaking such activity or activities, of that previous year;

Illustrated:

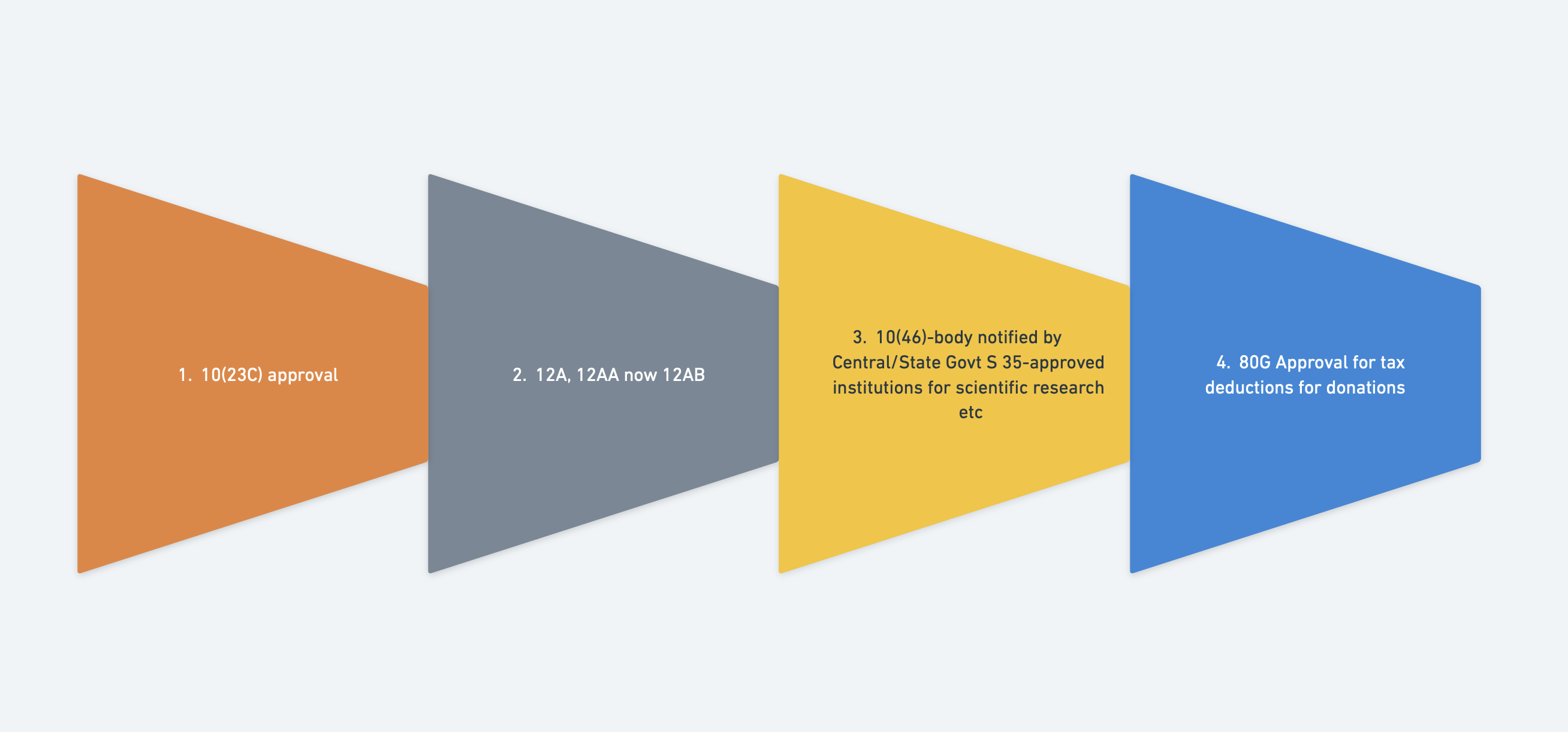

- 10(23C) approval

- 12A, 12AA now 12AB

- 10(46)-body notified by Central/State Govt S 35-approved institutions for scientific research etc.

- 80G Approval for tax deductions for donations

Section 10(23C) entities

|

Section |

Non Approval |

Section |

Approval |

|

10(23C)(iiiab) |

Educational institution wholly/substantially financed by Govt |

10(23C)iv |

National Fund/Charitable institution of national importance |

|

10(23C)(iiiac) |

Medical institution wholly/substantially financed by Govt |

10(23C)v |

Religious institution or religious cum charitable institution notified by Govt |

|

10(23C)(iiiad) |

Educational institution gross receipts less than Rs.5 cr in a FY |

10(23C)vi |

Educational institution gross receipts more than Rs. 5 cr in a FY |

|

10(23C)(iiiae) |

Medical institution gross receipts less than Rs.5 cr in a FY |

10(23C)via |

Medical institution gross receipts more than Rs.5 cr in a FY |

Two recent Landmark SC judgements in October 2022

-

10 (23C)(vi) entities should be solely (exclusively) for educational purposes, can undertake business activity incidental to the main object but not otherwise. Can generate surplus in course of pursuing main objects

-

For GPU entities, commercial activity only for advancement of GPU. Markup has to be reasonable for such commercial activity. The commercial activity should not be feeding charity

New regime of registration for charitable organisations wef 1.4.2021

-

Re-registration/approval of charitable entities u/s 10(23C), 12A,35 and 80G approval for a period of 5 years, thereafter renewal once every 5 years. Perpetual registration abolished.

-

Department wants to have database and better control/monitoring on charitable institutions which has been fragmented and decentralised until now

Types of Approvals:

-

Re-registration/Revalidation of existing registered entities-5 years

-

Provisional registration for new entities-3 years

-

Regular registration for existing unregistered entities-5 years

-

Provisional to Normal registration for new entities- Total period 5 years

-

Modification of objects clause for 12A entities

-

If registered both under 10(23C) or 10(46) and 12A, then retain 10(23C) or 10(46) for 5 years

-

Renewal of registration after 5 years

New Regime and Forms

Coverage:

-

Re registration/re approval under 10(23C)/12A/80G-existing registered

-

Registration/re approval under 10(23C)/12A/80G-existing un-registered

-

Provisional registration under 10(23C)/12A/80G-new entities

-

Statement of donation u/s 80G

-

Receipt/Certificate of donation u/s 80G

Forms:

-

10A-Re-registration and provisional registration

-

10AC-Approval of 10A by CIT

-

10AB-Registration of existing unregistered entities, conversion of provisional to normal registration, Renewal, change in objects and one of the two registrations made inoperative.

-

10AD- Approval of 10AB by CIT

-

10BD-Statement of donations u/s 80G

-

10BE-Receipt of donation u/s 80G

Action for existing registered entities

-

Common Form 10A for 10(23C), 12AA, 80G, 35 entities-select code for respective sections e.g. 01 for 12A and 11 for 80G.

-

Submission date-30.9.2023 vide CBDT circular 6 of May 2023

-

CIT order within 3 months after month of application in 10AC Form. Registration valid for 5 years

-

No inquiry. 10A-not completely filled, CIT may cancel after giving opportunity of being heard

-

Renewal in Form 10AB after 5 years within 6 months of expiry and after due inquiry process

-

If registered entity missed due date and applied for provisional registration, it can surrender and apply for regular registration in 10A upto 30.9.23

Action for existing un-registered entities

Existing unregistered entities:

- Apply only in Form 10AB upto 30.9.23 provided no exemption claimed earlier.

Others:

- All pending applications rejected due to missing the due date would be considered valid.

- Entities to be treated unregistered for section 115TD post 30.9.23

Action for Provisional Registration

- Effective from the previous year relevant to assessment year from which the said registration is sought. Applicable only when charitable activity not commended as confirmed in 10A and 10AB

- Form 10A

- CIT approval within 1 month from the end of month in which application was made. No inquiry

- Validity 3 years, convert to normal registration within 6 months of commencement of charitable activities or 6 months before expiry of provisional registration whichever is earlier.

- For normal registration, Form 10AB. Due process of inquiry

Section 80G

Statement of donation

- 80G provisions: Cash donation upto Rs.2k permitted, not in kind and only through banking channels. No anonymous donation permitted u/s 80G

- Form 10BD-points to remember:

- Donation type:

- Corpus

- Specific

- Others

- UIN of donor-PAN, Aadhar

- If PAN / Aadhaar is not available then either the passport No. /Elector’s photo identity / Driving License/ Ration Card/Taxpayer identification Number where the person resides outside India.

- Mode of receipt-cash, kind, electronic and cheque, others

- File by 31st May for each FY

- Penalty for delayed filing

Receipt/certificate of donation

-

Form 10BE

-

Immediate issue after filing 10BD

-

Linked to UIN of donor

-

Penalty for delay

-

Generation and download of donation receipt from web portal after filing 10BD

-

Issue the system generated 10BE only to donors for claiming 80G benefit.

Code of Taxation for Charitable Institutions

Chapter III-Incomes which do not form part of total income

|

1. |

Section 11 Income from property held under trust for charitable or religious purposes. |

|

2. |

Section 12 Income of trusts or institutions from voluntary contributions for charitable and relgious purposes. Section 12A – Conditions for applicability of sections 11 and 12 Section 12AA – Procedure for Registration-repealed Section 12AB – Procedure for Registration under new regime |

|

3. |

Section 13 Section 11 not to apply in certain cases. |

Section 11

Income from property held for charitable or religious purposes

The following income shall not be included in the total income of the previous year of the person in receipt of the income:

-

Income derived from property held under trust wholly for charitable or religious purposes, to the extent to which such income is applied to such purposes in India; and, where any such income is accumulated or set apart for application to such purposes in India, to the extent to which the income so accumulated or set apart is not in excess of fifteen percent of the income from such property;

-

Income in the form of voluntary contributions made with a specific direction that they shall form part of the corpus of the trust or institution.

Deemed Application-1 year

As per clause (2) of Explanation to section 11(1):

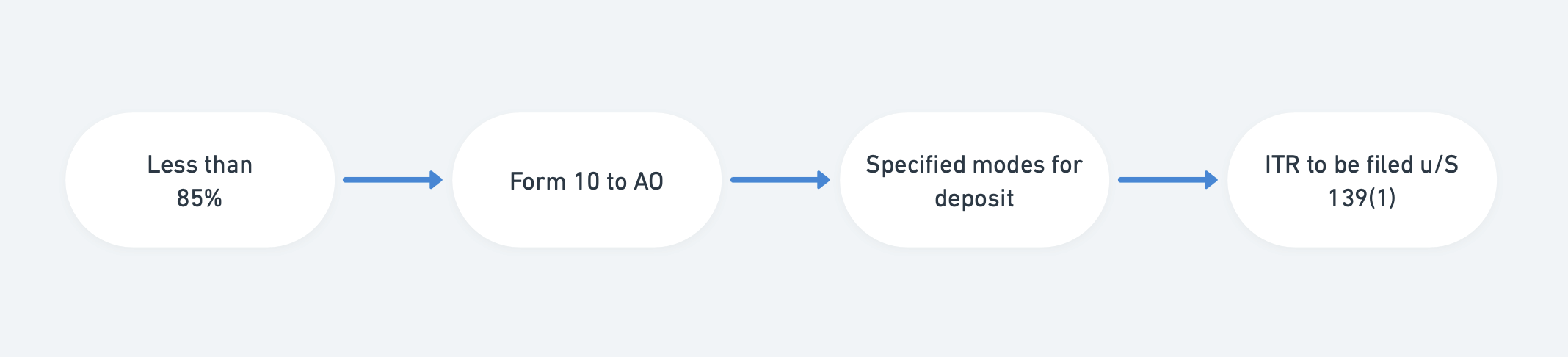

If, in the previous year, the income applied to charitable or religious purposes in India falls short of eighty-five per cent of the income derived during that year from property held under trust, or, as the case may be, held under trust in part, by any amount—

- for the reason that the whole or any part of the income has not been received during that year, or

- for any other reason,

Then at the option of the person in receipt of the income (such option to be exercised before the expiry of the time allowed under sub-section (1) of section 139 for furnishing the return of income in form -9A), be deemed to be income applied to such purposes during the previous year in which the income was derived.

Note: If the amount accumulated as per clause (2) of Explanation to section 11(1) is not utilised in the next year then the amount accumulated will be taxable income.

Accumulation-5 years

As per section 11(2):

If, in the previous year, the income applied to charitable or religious purposes in India falls short of eighty-five per cent of the income derived during that year from property held under trust, but is accumulated or set apart, either in whole or in part, for application to such purposes in India, such income so accumulated or set apart shall not be included in the total income of the previous year of the person in receipt of the income, provided the following conditions are complied with, namely:

-

Such person furnishes a statement in the prescribed form (Form 10) and in the prescribed manner (Online) to the Assessing Officer, stating the purpose for which the income is being accumulated or set apart and the period for which the income is to be accumulated or set apart, which shall in no case exceed five years;

-

The money so accumulated or set apart is invested or deposited in the forms or modes specified in sub-section (5) and utilised for the purpose for which accumulated

-

Not transferred to an entity covered under Section 12A of the Act

-

The statement referred to in clause (a) is furnished on or before the due date specified under sub- section (1) of section 139 for furnishing the return of income for the previous year.

Illustrated: Less than 85% ➡️ Form 10 to AO ➡️ Specified modes for deposit ➡️ ITR to be filed u/S 139(1)

Section 11(4)

Business income of charitable institution

-

(4) For the purposes of this section "property held under trust" includes a business undertaking so held, and where a claim is made that the income of any such undertaking shall not be included in the total income of the persons in receipt thereof, the Assessing Officer shall have power to determine the income of such undertaking in accordance with the provisions of this Act relating to assessment; and where any income so determined is in excess of the income as shown in the accounts of the undertaking, such excess shall be deemed to be applied to purposes other than charitable or religious purposes.

-

(4A) Sub-section (1) or sub-section (2) or sub-section (3) or sub-section (3A) shall not apply in relation to any income of a trust or an institution, being profits and gains of business, unless the business is incidental to the attainment of the objectives of the trust or institution, and separate books of account are maintained by such trust or institution in respect of such business.

Section 11(5)

Modes of investment

The forms and modes of investing or depositing the money referred to in clause (b) of sub- section (2) shall be the following, namely:

-

Investment in savings certificates as defined in clause (c) of section 2 of the Government Savings Certificates Act, 1959 (46 of 1959), and any other securities or certificates issued by the Central Government under the Small Savings Schemes of that Government;

-

Deposit in any account with the Post Office Savings Bank

-

Deposit in any account with a scheduled bank or a co-operative society engaged in carrying on the business of banking (including a co-operative land mortgage bank or a co-operative land development bank)

-

Investment in units of the Unit Trust of India established under the Unit Trust of India Act, 1963 (52 of 1963)

-

Investment in any security for money created and issued by the Central Government or a State Government

-

Investment in debentures issued by, or on behalf of, any company or corporation both the principal whereof and the interest whereon are fully and unconditionally guaranteed by the Central Government or by a State Government

-

Investment or deposit in any public sector company:

-

Deposits with or investment in any bonds issued by a financial corporation which is engaged in providing long- term finance for industrial development in India and which is eligible for deduction under clause (viii) of sub- section (1) of section 36

-

Deposits with or investment in any bonds issued by a public company formed and registered in India with the main object of carrying on the business of providing long-term finance for construction or purchase of houses in India for residential purposes and which is eligible for deduction under clause (viii) of sub-section (1) of section 36;

-

Deposits with or investment in any bonds issued by a public company formed and registered in India with the main object of carrying on the business of providing long-term finance for urban infrastructure in India

-

Investment in immovable property.

Further additions to 11(5)

Additional as per Rule 17C (March 2018)

-

Investment in units of any scheme of a mutual fund

-

Deposit with authority for low cost housing

-

Stock certificate of Sovereign Gold Bonds

-

Debt instruments of infrastructure finance company

-

Acquiring shares of NSDC, Depository.

Example of Computation

|

Case 1 |

|

|

Income derived from property held under trust wholly for charitable purposes |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-850 |

|

Less: Accumulation under section 11(1)(a) No Specific Form |

-150 |

|

Taxable Income |

NIL |

|

Case 2 |

|

|

Income derived from property held under trust wholly for charitable purposes |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-600 |

|

Less: Accumulation under section 11(1)(a) No Specific Form |

-150 |

|

Less: Accumulation under section (11) (2): Form 10, Specific Purpose |

-250 |

|

Taxable Income |

NIL |

|

Case 3 |

|

|

Income derived from property held under trust wholly for charitable purposes (Rs 200 was received in March) |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-650 |

|

Less: Accumulation under section 11(1)(a) No Specific Form (15% of 1000) |

-150 |

|

Less: Accumulation as per clause (2) of Explanation to section 11(1), Form 9 |

-200 |

|

Taxable Income |

NIL |

Disallowance of Cash/bearer Payments

Section 40(A)(3) provides that “Where the assessee incurs any expenditure in respect of which a payment or aggregate of payments made to a person in a day, otherwise than by an account payee cheque drawn on a bank or account payee bank draft or use of electronic clearing system through a bank account [or through such other electronic mode as may be prescribed], exceeds Ten Thousand Rupees, no deduction shall be allowed in respect of such expenditure”.

Note:

- The expenditure as disallowed above, will be taxed @ 31.2% at the time of filing the Income Tax Return.

- The cash payments made by staffs and reimbursed by organisation shall also be treated as cash payment.

- Disclose non-compliances in ITR, if same noticed by Assessing Office during Income Tax Assessment, additional penalty and interests may also be levied.

- Exceptions in Rule 60D.

Disallowance for Non Deduction of Tax at Source

Section 40(a)(ia) provides that 'Where the assessee fails to deduct the whole or any part of the tax in accordance with the provisions of Chapter XVII-B then the amount equal to 30% of expenditure shall not be allowed at the time of computation of Income’

Note:

-

The expenditure as disallowed above, will be taxed @ 31.2% at the time of filing the Income Tax Return.

-

Disclose non-compliances in ITR, if same noticed by the Assessing Office during Income Tax Assessment, additional penalty and interests may also be levied.

Example of Computation

|

Case 4 |

|

|

Income derived from property held under trust wholly for charitable purposes |

1000 |

|

Less: Expenditure (Income applied to charitable purposes in India) |

-650 |

|

Less: Accumulation under section 11(1)(a) No Specific Form (15% of 1000) |

-150 |

|

Less: Accumulation under section (11) (2): Form 10, Specific Purpose |

-200 |

|

Add: Expenditure disallowed under section 40 and 40A (30% Expenditure) |

30 |

|

Taxable Income 30 |

30 |

|

Tax on Income @ 30% |

9 |

|

Add: Surcharge @ 4% |

0.36 |

|

Total Tax Liability |

9.36 |

Section 12

Income of trust/ institution from Contribution

Section 12 (1):

Any voluntary contributions received by a trust created wholly for charitable or religious purposes or by an institution established wholly for such purposes (not being contributions made with a specific direction that they shall form part of the corpus of the trust or institution) shall for the purposes of section 11 be deemed to be income derived from property held under trust wholly for charitable or religious purposes and the provisions of that section and section 13 shall apply accordingly.

Section 12 (2):

The value of any services, being medical or educational services, made available by any charitable or religious trust running a hospital or medical institution or an educational institution, to any person referred to in clause (a) or clause (b) or clause (c) or clause (cc) or clause (d) of sub-section (3) of section 13, shall be deemed to be income of such trust or institution derived from property held under trust wholly for charitable or religious purposes during the previous year in which such services are so provided and shall be chargeable to income-tax notwithstanding the provisions of sub-section (1) of section 11

Section 12A

Conditions for Applicability of Section 11 & 12

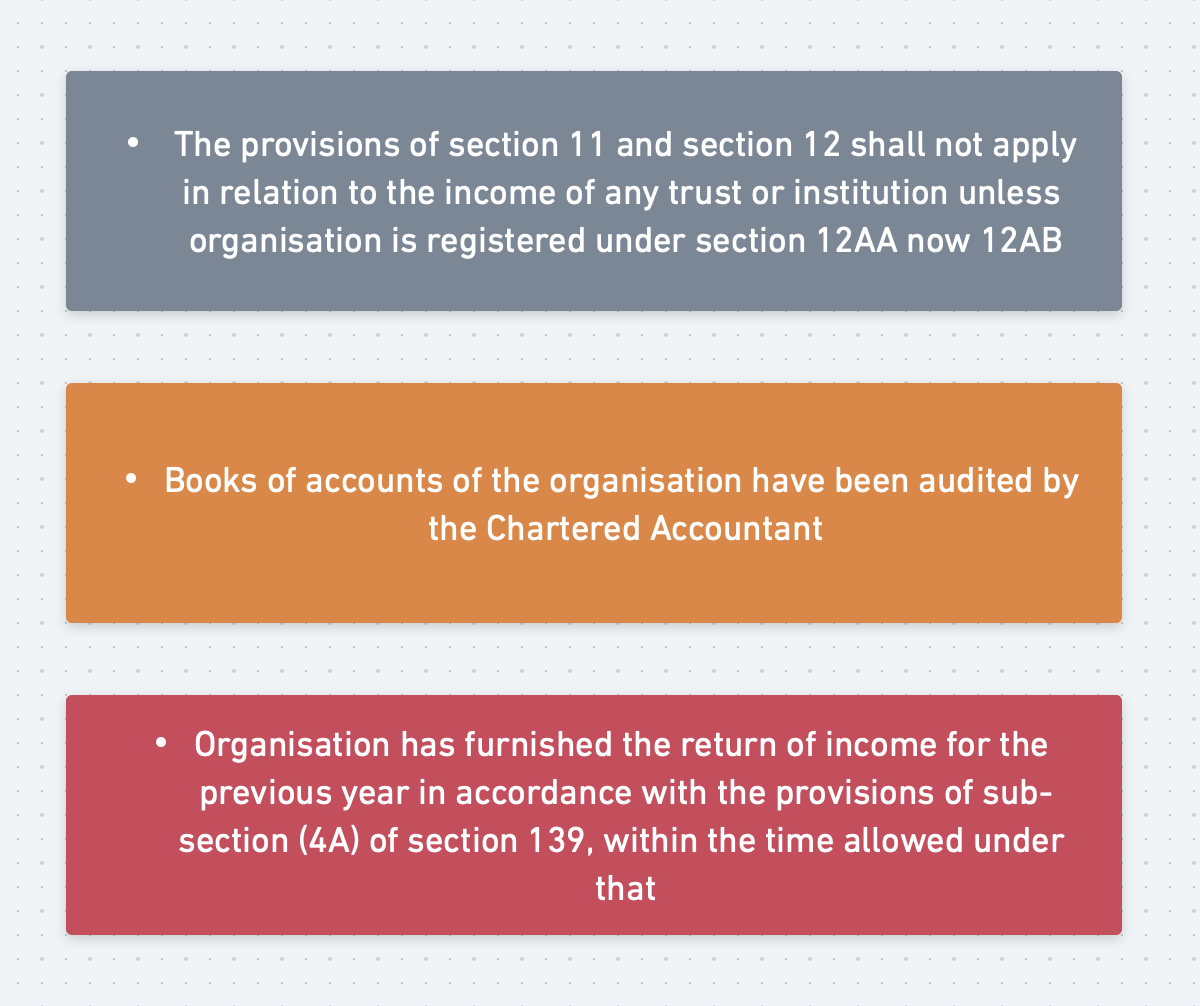

Illustrated:

- The provisions of section 11 and section 12 shall not apply in relation to the income of any trust or institution unless organisation is registered under section 12AA now 12AB

- Books of accounts of the organisation have been audited by the Chartered Accountant

- Organisation has furnished the return of income for the previous year in accordance with the provisions of sub-section (4A) of section 139, within the time allowed under that

Section 13

Section 13 of Income Tax

Section 13(1):

Section 11 not to apply when:

-

Trust for private religious purposes which does not ensure for the benefit of the public.

-

Trust for charitable purposes or a charitable institution created or established after the commencement of this Act, any income thereof if the trust or institution is created or established for the benefit of any particular religious community or caste.

-

If such trust or institution has been created or established after the commencement of this Act and under the terms of the trust or the rules governing the institution, any part of such income ensures, directly or indirectly for the benefit of any person referred to in sub-section (3).

-

If any part of such income or any property of the trust or the institution (whenever created or established) is during the previous year used or applied, directly or indirectly for the benefit of any person referred to in sub-section (3).

-

Non compliance of Section 11(5)-permitted modes of investment

Section 13(6):

The exemption under section 11 or section 12 shall not be denied in relation to any income, other than the income referred to in sub-section (2) of section 12, by reason only that such trust has provided educational or medical facilities to persons referred to in sub section 3.

Section 13(3)

List of persons:

Section 13(2):

The income or the property of a trust deemed to have been used or applied for the benefit of a person referred to in 13(3)

-

If any part of the income or property of the trust or institution is, or continues to be, lent to any person referred to in sub-section (3) for any period during the previous year without either adequate security or adequate interest or both.

-

If any land, building or other property of the trust or institution is, or continues to be, made available for the use of any person referred to in sub-section (3), for any period during the previous year without charging adequate rent or other compensation;

-

If any amount is paid by way of salary, allowance or otherwise during the previous year to any person referred to in sub-section (3) out of the resources of the trust or institution for services rendered by that person to such trust or institution and the amount so paid is in excess of what may be reasonably paid for such services;

-

If the services of the trust or institution are made available to any person referred to in sub-section (3) during the previous year without adequate remuneration or other compensation;

-

If any share, security or other property is purchased by or on behalf of the trust or institution from any person referred to in sub-section (3) during the previous year for consideration which is more than adequate;

-

If any share, security or other property is sold by or on behalf of the trust or institution to any person referred to in sub-section (3) during the previous year for consideration which is less than adequate

-

If any income or property of the trust or institution is diverted during the previous year in favour of any person referred to in sub-section (3)

Finance Act 2023

Amendments for charitable entities

-

Application made from corpus funds or through loans and borrowings only if replenished/repaid in 5 years

-

Retrospective section 11 exemption benefit withdrawn

-

Inter charity donations of local funds-85% of amount as application

-

Exemption benefit not available for Updated IT Return

-

Timeline for filing Form 9A and 10

-

No provisional registration for existing unregistered entities

-

Exit tax in case of non renewal, non re registration or not converting provisional to normal registration

-

Incorrect or incomplete information in Form 10A a specified violations inviting cancellation of registration

Finance Act 2022

Amendments for charitable entities

-

Monitoring and effective implantation:

- Proper book of accounts to be maintained for 12AB and 10(23C) entities-form, manner and place as may be prescribed.

- Power to cancel registration for specified violations i.e. spent income for other than object, business income not incidental and no separate books, private religious purpose, particular religious community/caste, violation of other laws, benefits u/s 13, not reasonable, section 11(5) non compliance, conditions not complied specified in registration certificate (Form 10AC). Reference to be made by AO for passing order by CIT/PCIT who shall pass order cancelling or refusing within 6 months from quarter in which notice was issued.

-

Consistency in 2 regimes with a view to have one regime in future:

-

Accumulation of income-not spent in 5 years or taxed in 5th year itself, not 6th year and applicable to 10(23C) entities also. Delay due to court injunction etc, the period will be excluded in calculating the accumulation period. Repurposing of accumulation can be permitted by the Department.

-

10(23C) IT return and books of accounts for 12 A entities.

-

115TD applicable to 10(23C) entities also.

-

Clarity:

-

Tax @30% (S. 115BBI) on denied income for 13(1)© and 13(1(d) violations. Penalty for providing unreasonable benefits to specified persons- s 271AAE penalty equal to amount of benefit in first year and twice for subsequent year

-

Provision cannot be claimed as application, actual spend/payment only is application.

-

VC received by religious institutions for repair and maintenance of religious institutions treated as corpus and not treated as income even without specific direction from the donor from FY 20-21 but should be invested in specified modes

-

Newly inserted section 13(10) & 13(11)-Computation of taxable income due to specified non compliance i.e. books of accounts, non filing ITR, Audit report, commercial receipts in excess of 20%. Claim admissible revenue expenditure from income subject to expenditure not from corpus, loans and borrowings, depreciation if cost claimed, donation to other organisations and after disallowing 40A(3) and 40(a)(ia) cases. Beneficial since entire income is not taxed

Finance Act 2021

Amendments for charitable entities

-

Use of Corpus no longer application : Application for charitable or religious purposes from the corpus fund shall not be treated as application of income for charitable or religious purposes. Provided that the amount not so treated as application, or part thereof, shall be treated as application for charitable or religious purposes in the previous year in which the amount, or part thereof, is invested or deposited back, into one or more of the forms or modes specified in sub-section (5) maintained specifically for such corpus, from the income of that year and to the extent of such investment or deposit.

-

Exclusion of Corpus Fund from Income (conditional): Any Voluntary Contribution made with a specific direction that they shall form part of the corpus of the trust or institution shall not be included in the total income of such trust or institution unless such voluntary contribution is invested or deposited in one or more of the forms or mode specified in the act.

-

Use of Loans / Borrowings no longer applies except during repayment : Any expenditure made for charitable or religious purpose out of loan or borrowing shall not be treated as application for charitable or religious purpose. Provided such amount shall be treated as application for charitable or religious purposes at the time of repayment of such loan.

-

Carry forward of Losses not allowed: Calculation of income required to be applied or accumulated during the previous year shall be made without any set off or deduction or allowance of any excess application of any of the year preceding the previous year

Maintaining Books of accounts for NGOs

-

There was no regulation regarding books of accounts by NGOs upto FY 21-22

-

Section 12A(1)(b)(i) inserted for maintaining of books of accounts and other documents wef AY 23-24.

-

Not applicable if total income is below threshold chargeable to tax.

-

Rule 17AA inserted from 10.8.2022 providing for four sub rules

1. Books of accounts & other documents

The specified books of accounts shall include:

-

cash book

-

ledger

-

journal

-

copies of serially numbered receipts, original copy of invoices, etc

Other documents include:

-

Record of all the projects and institutions run by the organisation

-

Record of income of the organisation during the previous year

- voluntary contribution containing details of name of the donor, address, permanent account number (if available) and Aadhaar number (if available);

- income from property held under trust referred to under section 11 of the Act along with list of such properties;

- income of trust other than the contribution referred in items (I) and (II)

- Record of application out of the income during the year

- application of income in India, containing details of amount of application; name and address of the person to whom any credit or payment is made and the object for which such application is made, amount credited or paid

- application of income outside India, containing details of amount of application, name and address of the person to whom any credit or payment is made and the object for which such application is made;

- deemed application of income referred in section 11(1) of the Act containing details of the reason for availing such deemed application;

- income accumulated or set apart as per section 11(2) containing details of the purpose for which such income has been accumulated;

- money invested or deposited in the forms and modes specified in 11(5)

- money invested or deposited in the forms and modes other than those specified in 11(5)

-

Record of specified application out of the income of preceding years

-

Record of voluntary contribution with a specific direction to form Corpus

- the contribution received containing details of name of the donor, address, permanent account number and Aadhaar number;

- application out of such voluntary contribution referred to in item (I) containing details of amount of application, name and address of the person to whom any credit or payment is made and the object for which such application is made; amount credited or paid towards corpus to 12AB or 10(23C) institution;

- the forms and modes specified in section 11(5) of the Act in which such voluntary contribution, received during the previous year, is invested or deposited;

- money invested or deposited in the forms and modes other than those specified in 11(5)

-

Record of contribution received under 80G(2)(b) being treated as corpus

-

Record of Loans and Borrowings

- information regarding amount and date of loan or borrowing, amount and date of repayment, name of the person from whom loan taken, address of lender, permanent account number and Aadhaar number (if available) of the lender;

- application out of such loan or borrowing containing details of amount of application, name and address of the person to whom any credit or payment is made and the object for which such application is made;

- application out of such loan or borrowing, received during any previous year preceding the previous year, containing details of amount of application, name and address of the person to whom any credit or payment is made;

- repayment of such loan or borrowing (which was applied during any preceding previous year and not claimed as application) during the previous year.

-

Record of properties held by the assessee

- immovable properties containing details of,

- nature, address of the properties, cost of acquisition of the asset, registration documents of the asset;

- transfer of such properties, the net consideration utilised in acquiring the new capital asset;

- (movable properties including details of the nature and cost of acquisition of the asset

- immovable properties containing details of,

-

Record of specified persons, as per section 13 (3) of the Act

- containing details of their name, address, permanent account number and Aadhaar number(if available);

- transactions undertaken with specified persons under 13(3) containing details of date and amount of such transaction, nature of the transaction and documents to the effect that such transaction is, directly or indirectly, not for the benefit of such specified person.

-

Any other document.

2. Form of keeping books of accounts and documents: Kept in written form or electronic form or digital form or print-outs of data stored in electronic form or in digital form or any other form of electromagnetic data storage device.

3. Place of maintaining books of accounts and other documents: shall be kept and maintained at its "registered office“. If the accounts are maintained other than the registered office or at various project locations, intimate assessing Officer in writing, giving full address of the other places supported by resolution of the board

4. Period for which books of accounts & other documents should be kept: Kept and maintained for a period of ten years from the end of the relevant assessment year

-

Organisation having income subject to section 11(4) and 11(4)(a) to maintain a separate set of books of account of such income in line with the provision under Income Tax Act.

-

Implication of Non-Maintenance of Books of Account.

Section 13(10) and (11) inserted wef AY 22-23 stating that Income chargeable to tax shall be computed after allowing a deduction for expenditure incurred for the objects of the institution as specified in this section subject to fulfilment of the following conditions, namely:

-

Such expenditure is not from the corpus standing to the credit of such trust or institution

-

Such expenditure is not from any loan or borrowing;

-

Claim of depreciation is not in respect of an asset, acquisition of which has been claimed as an application of income in the same or any other previous year; and

-

Such expenditure is not in the form of any contribution or donation to any person.

-

Such expenditure violating section 40(3) and 40(a)(ia) disallowed

-

Carry forward of loss and expenditure/decurion not allowed except under the Code from section 11-13.

Please note: Information is for reference only. Read our disclaimer here.

No Comments